NOTES TO THE FINANCIAL STATEMENTS

30 JUNE 2016

NOTE 1. BASIS OF PREPARATION

These general purpose financial statements have been prepared in accordance with Australian Accounting Standards

and Interpretations issued by the Australian Accounting Standards Board (‘AASB’) and the Corporations Act 2001, as

appropriate for for-profit oriented entities. These financial statements also comply with International Financial Reporting

Standards as issued by the International Accounting Standards Board (‘IASB’).

Historical cost convention

The financial statements have been prepared under the historical cost convention, except for the revaluation of derivative

financial instruments at fair value.

Net current asset deficiency

As at 30 June 2016, Vocus’ current liabilities exceeded its current assets by $66,880,000. Vocus is satisfied that it will be

able to meet all its obligations as they fall due given its strong profitability and operating cash flows, existing cash reserves

and available finance facilities.

Critical accounting estimates

The preparation of the financial statements requires the use of certain critical accounting estimates. It also requires

management to exercise its judgement in the process of applying Vocus’ accounting policies. The areas involving a higher

degree of judgement or complexity, or areas where assumptions and estimates are significant to the financial statements,

are disclosed in note 2.

Parent entity information

In accordance with the Corporations Act 2001, these financial statements present the results of Vocus (as a Consolidated

entity) only. Supplementary information about the parent entity is disclosed in note 39.

NOTE 2. CRITICAL ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS

The preparation of the financial statements requires management to make judgements, estimates and assumptions that

affect the reported amounts in the financial statements. Management continually evaluates its judgements and estimates in

relation to assets, liabilities, contingent liabilities, revenue and expenses. Management bases its judgements, estimates and

assumptions on historical experience and on other various factors, including expectations of future events, management

believes to be reasonable under the circumstances. The resulting accounting judgements and estimates will seldom equal

the related actual results. The judgements, estimates and assumptions that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities (refer to the respective notes) within the next financial year are

discussed below.

Estimation of useful lives of assets

The estimated useful lives and related depreciation and amortisation charges for its property, plant and equipment and

finite life intangible assets is determined by the Company. The useful lives could change significantly as a result of technical

innovations or some other event. The depreciation and amortisation charge will increase where the useful lives are less than

previously estimated lives, or technically obsolete or non-strategic assets that have been abandoned or sold will be written

off or written down.

Goodwill and other indefinite life intangible assets

The recoverable amount of the Australia and New Zealand CGU’s have been determined based on a fair value less costs

of disposal calculation. In assessing fair value less costs of disposal, Vocus estimates post tax future cash flows including

expected synergistic benefits from recent mergers, further capital expenditure and a long term growth rate assumption, and

discounts these cash flows using a post-tax rate. These assumptions require managements’ judgement and are based on

market expectations.

50 | VOCUS.COM.AU

NOTE 2. CRITICAL ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSUMPTIONS (continued)

Impairment of non-financial assets other than goodwill and other indefinite life intangible assets

Assessments of impairment of non-financial assets other than goodwill and other indefinite life intangible assets are made at

each reporting date by evaluating conditions specific to Vocus and to the particular asset that may lead to impairment. If an

impairment trigger exists, the recoverable amount of the asset is determined. This involves fair value less costs of disposal or

value-in-use calculations, which incorporate a number of key estimates and assumptions.

Derivative financial instruments

Forward foreign exchange contracts, designated as cash flow hedges, are measured at fair value. Reliance is placed on

future cash flows and judgement is made on a regular basis, through prospective and retrospective testing, including at the

reporting date, that the hedges are still highly effective.

Business combinations

As discussed in note 40, business combinations are initially accounted for on a provisional basis. The fair value of

assets acquired, liabilities and contingent liabilities assumed are initially estimated taking into consideration all available

information at the reporting date. Fair value adjustments on the finalisation of the business combination accounting is

retrospective, where applicable, to the period the combination occurred and may have an impact on the assets and

liabilities, depreciation and amortisation reported.

Unbilled revenue

Unbilled revenue for gas and electricity is estimated at the end of the reporting period. Customers are billed on a periodic

and regular basis. Management estimates customer consumption between the last invoice date and the end of the reporting

period. This is based on preliminary usage obtained from external regulators at an estimated bill rate. Various assumptions

and financial models are used to determine the estimated unbilled rate.

NOTE 3. OPERATING SEGMENTS

Reporting segments

Segment information is based on the information that management uses to make decisions about operating matters and

allows users to review operations through the eyes of management.

Operating segments represent the information reported to the chief operating decision makers (CODM), being the

executive management team, for the purposes of resource allocation and assessment of segment performance focuses on

the jurisdiction in which the services are delivered or provided.

Consistent with information presented for internal management reporting purposes, the result of each segment is measured

based on its EBITDA contribution. Corporate costs are allocated to segments (and included within segment EBITDA) with

reference to the resources allocated to provide those services to each segment.

The directors of Vocus have chosen to organise the Group around the two main jurisdictions in which the Group operates.

Specifically, the Group’s reportable segments under AASB 8 are as follows:

➜➜ Australia

➜➜ New Zealand

The reportable segments also represent the group’s cash-generating units for impairment testing purposes.

In the prior year, Vocus operated and disclosed as a single operating segment. The prior year reporting segment

information has been restated below in line with current year segments.

51

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

30 JUNE 2016

NOTE 3. OPERATING SEGMENTS (continued)

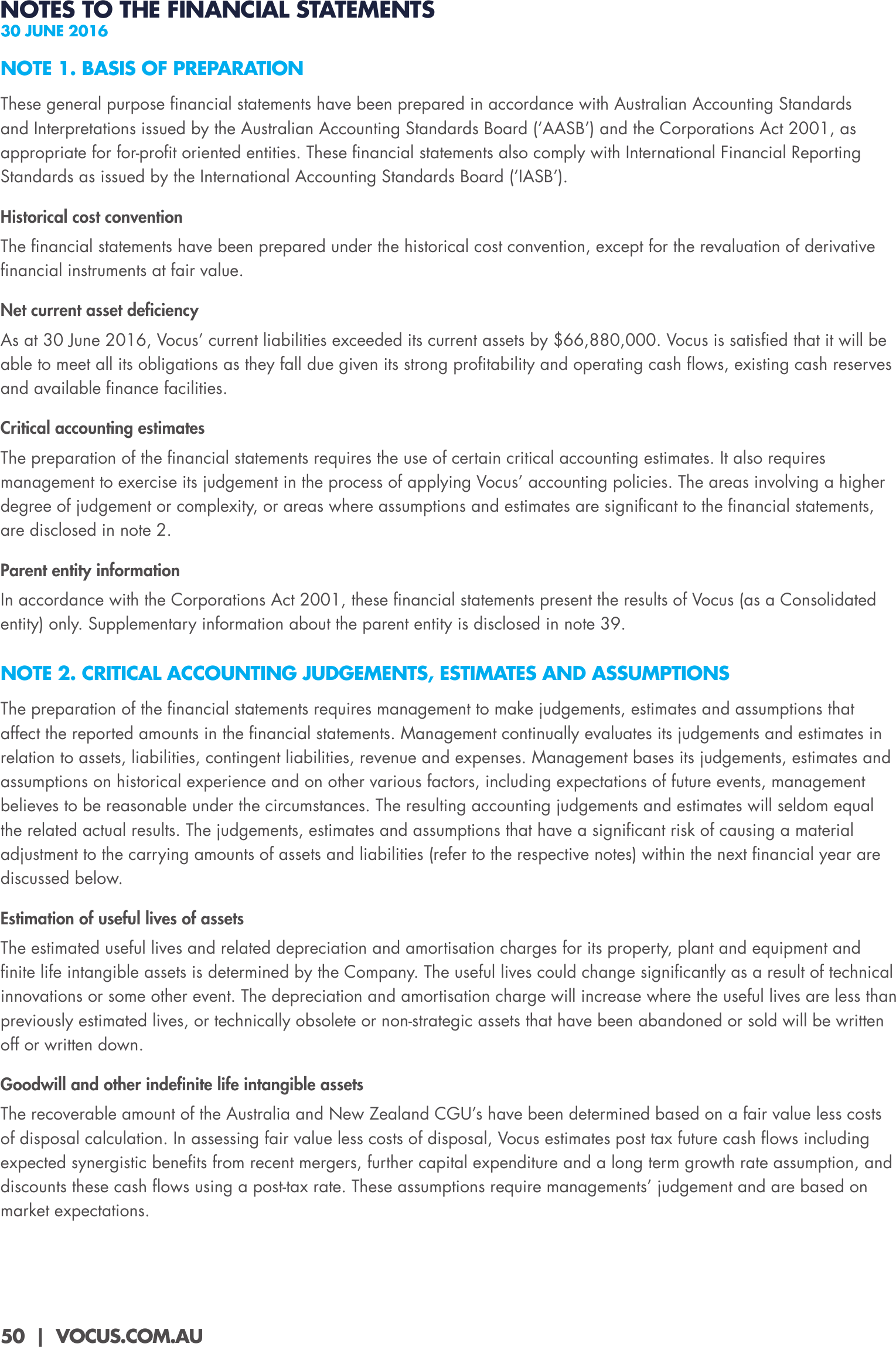

In addition to reportable segments, a summary of sales revenue by product has been provided below.

Sales revenue by product set

Consolidated

2016

2015

$’000

$’000

172,876

64,539

Internet

88,885

43,853

Data Centre

53,599

26,621

Voice

149,807

12,251

Consumer Telecommunications

287,355

-

Fibre and Ethernet

Consumer Energy

59,481

-

Other

17,935

1,740

829,938

149,004

Total sales revenue

Major customers

During the year ended 30 June 2016 there were no customers of Vocus which contributed 10% or more of external

revenue (2015: nil).

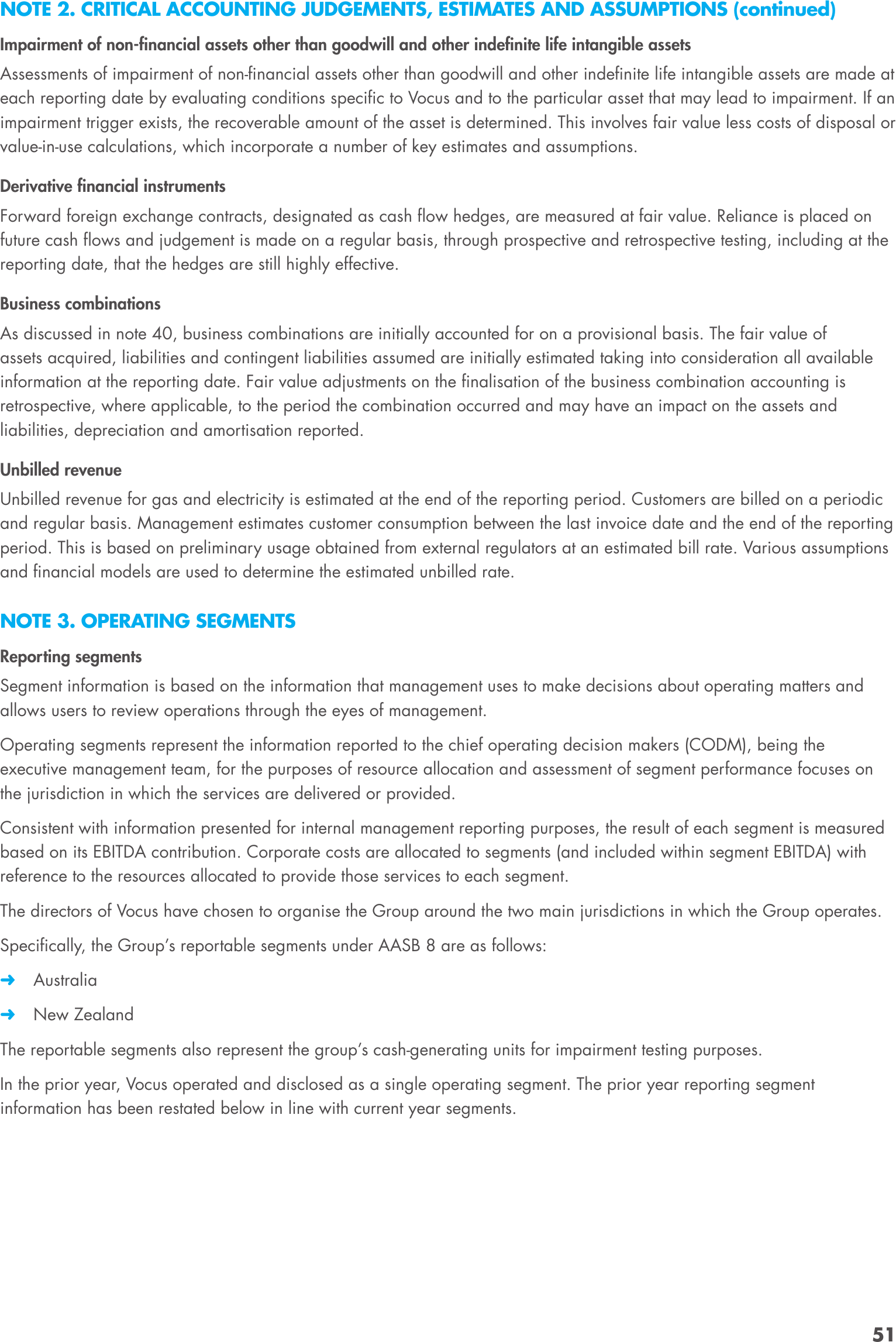

Segment revenues and results

Australia

New Zealand

Intersegment

adjustments

Total

$’000

$’000

$’000

$’000

696,236

144,609

(10,907)

829,938

1,707

40

(868)

879

7

1

-

8

Total revenue

697,950

144,650

(11,775)

830,825

EBITDA

170,641

25,183

(868)

194,956

Depreciation and amortisation

(68,103)

(10,384)

-

(78,487)

Finance costs

(16,815)

(8,517)

868

(24,464)

161

-

-

161

85,884

6,282

-

Consolidated - 2016

Revenue

Sales to external customers

Interest revenue

Other revenue

Non-controlling interest

Profit before income tax expense

Income tax expense

92,166

(27,914)

Profit after income tax expense

64,252

Assets

Segment assets

3,785,830

908,189

-

Total assets

4,694,019

4,694,019

Liabilities

Segment liabilities

Total liabilities

52 | VOCUS.COM.AU

1,272,797

246,937

-

1,519,734

1,519,734

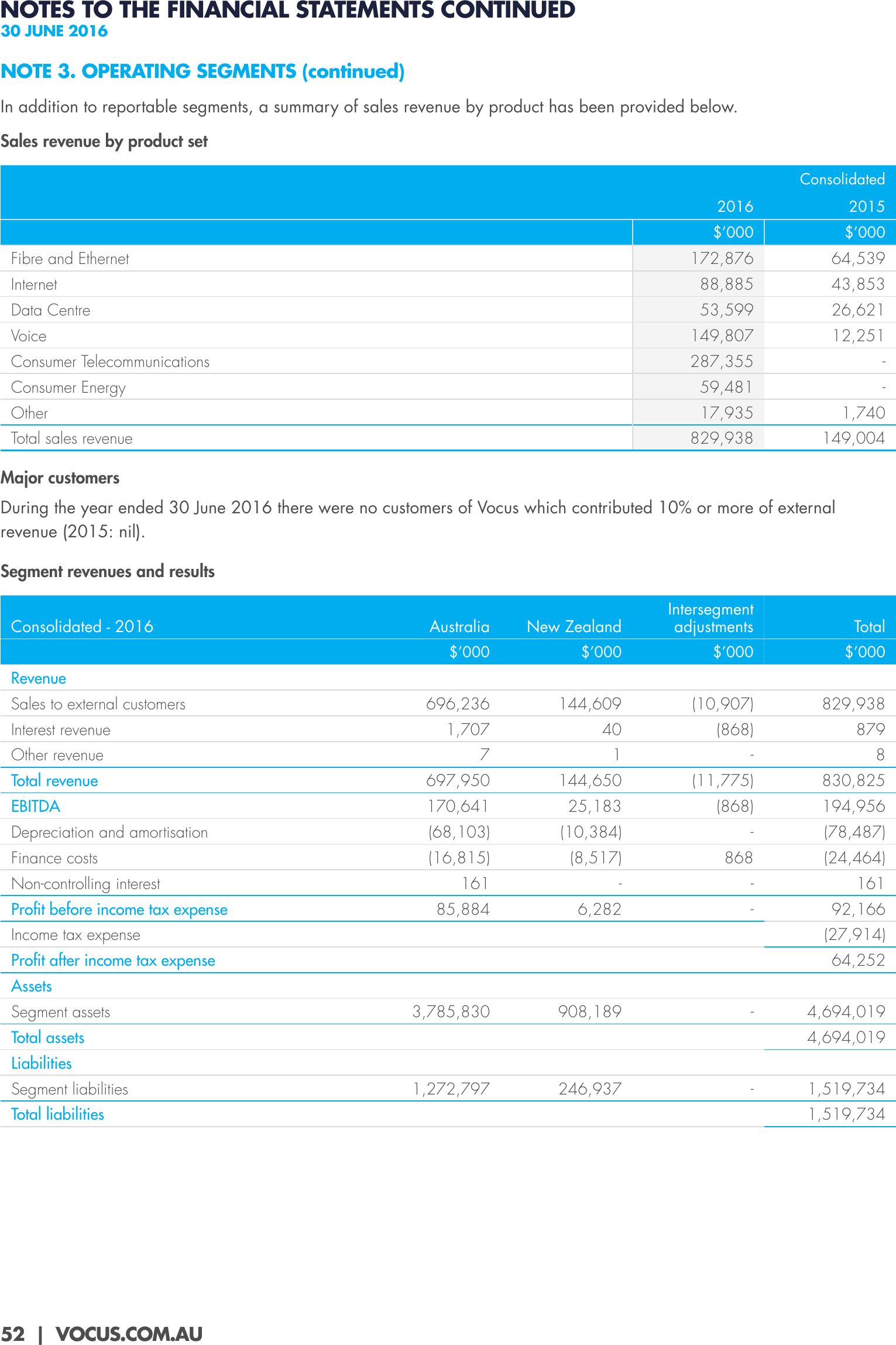

NOTE 3. OPERATING SEGMENTS (continued)

Australia

New Zealand

Intersegment

adjustments

Total

$’000

Consolidated - 2015

$’000

$’000

$’000

101,725

50,508

(3,229)

149,004

3,857

85

(3,147)

795

105,582

50,593

(6,376)

149,799

Revenue

Sales to external customers

Interest revenue

Total revenue

EBITDA

50,045

9,379

(6,382)

53,042

(12,549)

(6,135)

-

(18,684)

Finance costs

(2,201)

(7,019)

3,147

(6,073)

Profit/(loss) before income tax expense

35,295

(3,775)

(3,235)

28,285

Depreciation and amortisation

Income tax expense

(8,435)

Profit after income tax expense

19,850

Assets

Segment assets

229,251

154,093

-

Total assets

383,344

383,344

Liabilities

Segment liabilities

72,530

114,575

-

Total liabilities

187,105

187,105

Revenue by geographical area

Consolidated

2016

2015

$’000

$’000

Australia

669,257

81,937

New Zealand

148,890

58,721

Rest of World

11,791

8,346

829,938

149,004

Revenues from Rest of World customers are predominantly earned by the Australia operating segment.

Accounting policy for operating segments

Operating segments are presented using the ‘management approach’, where the information presented is on the same

basis as the internal reports provided to the Chief Operating Decision Makers (‘CODM’). The CODM are responsible for

the allocation of resources to operating segments and assessing their performance.

53

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

30 JUNE 2016

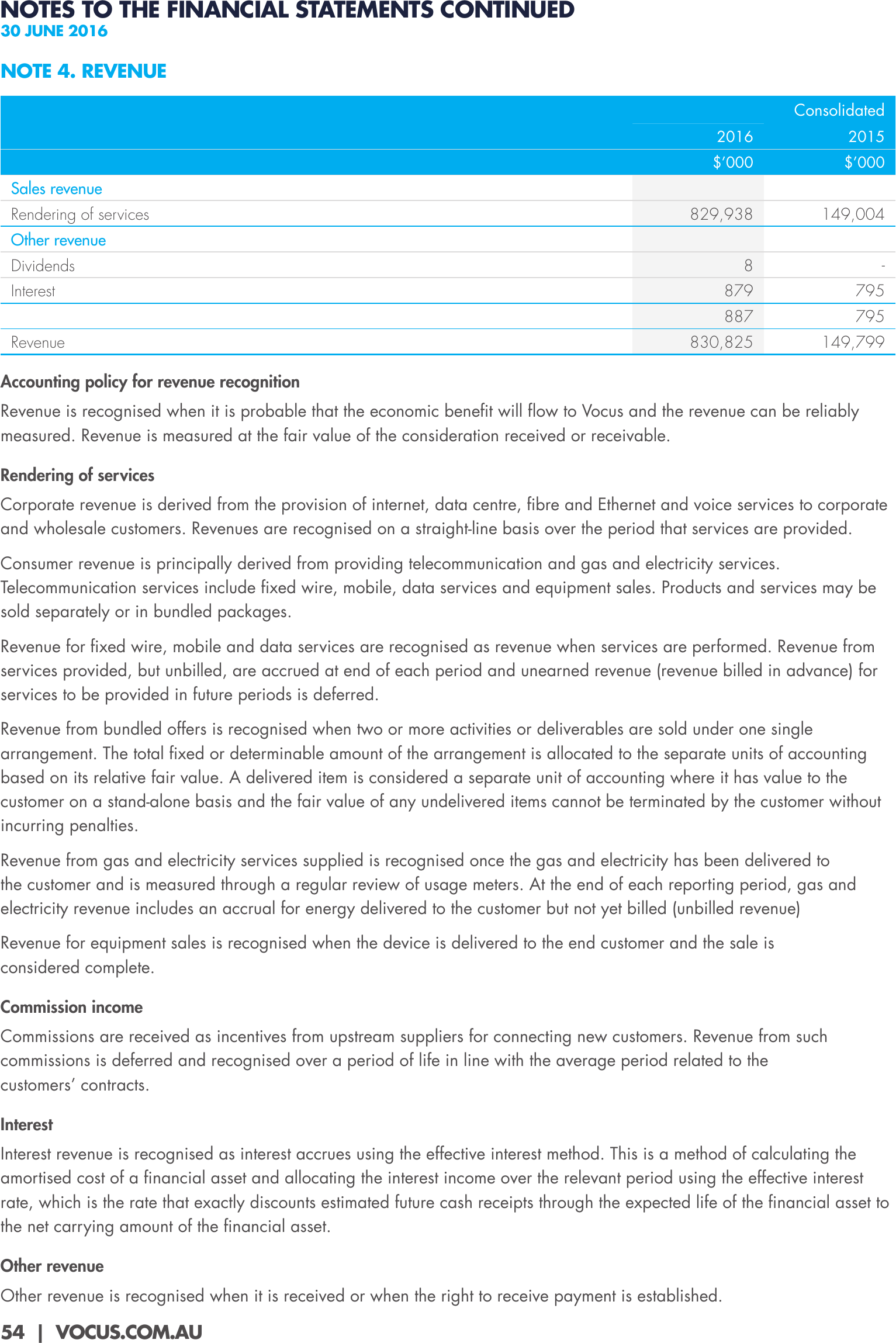

NOTE 4. REVENUE

Consolidated

2016

2015

$’000

$’000

829,938

149,004

8

-

Sales revenue

Rendering of services

Other revenue

Dividends

Interest

Revenue

879

795

887

795

830,825

149,799

Accounting policy for revenue recognition

Revenue is recognised when it is probable that the economic benefit will flow to Vocus and the revenue can be reliably

measured. Revenue is measured at the fair value of the consideration received or receivable.

Rendering of services

Corporate revenue is derived from the provision of internet, data centre, fibre and Ethernet and voice services to corporate

and wholesale customers. Revenues are recognised on a straight-line basis over the period that services are provided.

Consumer revenue is principally derived from providing telecommunication and gas and electricity services.

Telecommunication services include fixed wire, mobile, data services and equipment sales. Products and services may be

sold separately or in bundled packages.

Revenue for fixed wire, mobile and data services are recognised as revenue when services are performed. Revenue from

services provided, but unbilled, are accrued at end of each period and unearned revenue (revenue billed in advance) for

services to be provided in future periods is deferred.

Revenue from bundled offers is recognised when two or more activities or deliverables are sold under one single

arrangement. The total fixed or determinable amount of the arrangement is allocated to the separate units of accounting

based on its relative fair value. A delivered item is considered a separate unit of accounting where it has value to the

customer on a stand-alone basis and the fair value of any undelivered items cannot be terminated by the customer without

incurring penalties.

Revenue from gas and electricity services supplied is recognised once the gas and electricity has been delivered to

the customer and is measured through a regular review of usage meters. At the end of each reporting period, gas and

electricity revenue includes an accrual for energy delivered to the customer but not yet billed (unbilled revenue)

Revenue for equipment sales is recognised when the device is delivered to the end customer and the sale is

considered complete.

Commission income

Commissions are received as incentives from upstream suppliers for connecting new customers. Revenue from such

commissions is deferred and recognised over a period of life in line with the average period related to the

customers’ contracts.

Interest

Interest revenue is recognised as interest accrues using the effective interest method. This is a method of calculating the

amortised cost of a financial asset and allocating the interest income over the relevant period using the effective interest

rate, which is the rate that exactly discounts estimated future cash receipts through the expected life of the financial asset to

the net carrying amount of the financial asset.

Other revenue

Other revenue is recognised when it is received or when the right to receive payment is established.

54 | VOCUS.COM.AU

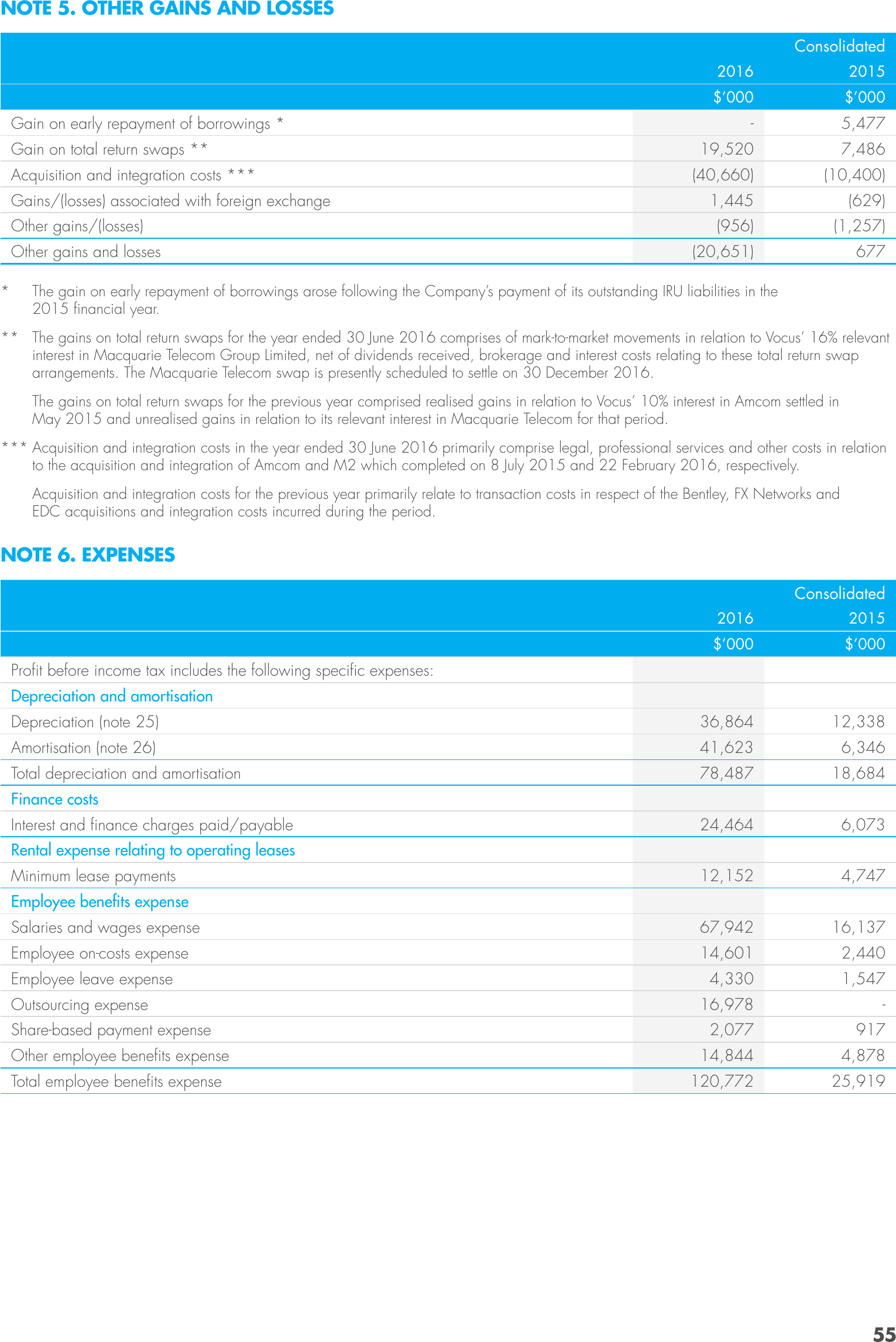

NOTE 5. OTHER GAINS AND LOSSES

Consolidated

2016

2015

$’000

Gain on early repayment of borrowings *

Gain on total return swaps **

Acquisition and integration costs ***

Gains/(losses) associated with foreign exchange

Other gains/(losses)

Other gains and losses

$’000

-

5,477

19,520

7,486

(40,660)

(10,400)

1,445

(629)

(956)

(1,257)

(20,651)

677

* The gain on early repayment of borrowings arose following the Company’s payment of its outstanding IRU liabilities in the

2015 financial year.

** The gains on total return swaps for the year ended 30 June 2016 comprises of mark-to-market movements in relation to Vocus’ 16% relevant

interest in Macquarie Telecom Group Limited, net of dividends received, brokerage and interest costs relating to these total return swap

arrangements. The Macquarie Telecom swap is presently scheduled to settle on 30 December 2016.

The gains on total return swaps for the previous year comprised realised gains in relation to Vocus’ 10% interest in Amcom settled in

May 2015 and unrealised gains in relation to its relevant interest in Macquarie Telecom for that period.

*** Acquisition and integration costs in the year ended 30 June 2016 primarily comprise legal, professional services and other costs in relation

to the acquisition and integration of Amcom and M2 which completed on 8 July 2015 and 22 February 2016, respectively.

Acquisition and integration costs for the previous year primarily relate to transaction costs in respect of the Bentley, FX Networks and

EDC acquisitions and integration costs incurred during the period.

NOTE 6. EXPENSES

Consolidated

2016

2015

$’000

$’000

Depreciation (note 25)

36,864

12,338

Amortisation (note 26)

41,623

6,346

Total depreciation and amortisation

78,487

18,684

24,464

6,073

12,152

4,747

Salaries and wages expense

67,942

16,137

Employee on-costs expense

14,601

2,440

4,330

1,547

Profit before income tax includes the following specific expenses:

Depreciation and amortisation

Finance costs

Interest and finance charges paid/payable

Rental expense relating to operating leases

Minimum lease payments

Employee benefits expense

Employee leave expense

Outsourcing expense

Share-based payment expense

Other employee benefits expense

Total employee benefits expense

16,978

-

2,077

917

14,844

4,878

120,772

25,919

55

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

30 JUNE 2016

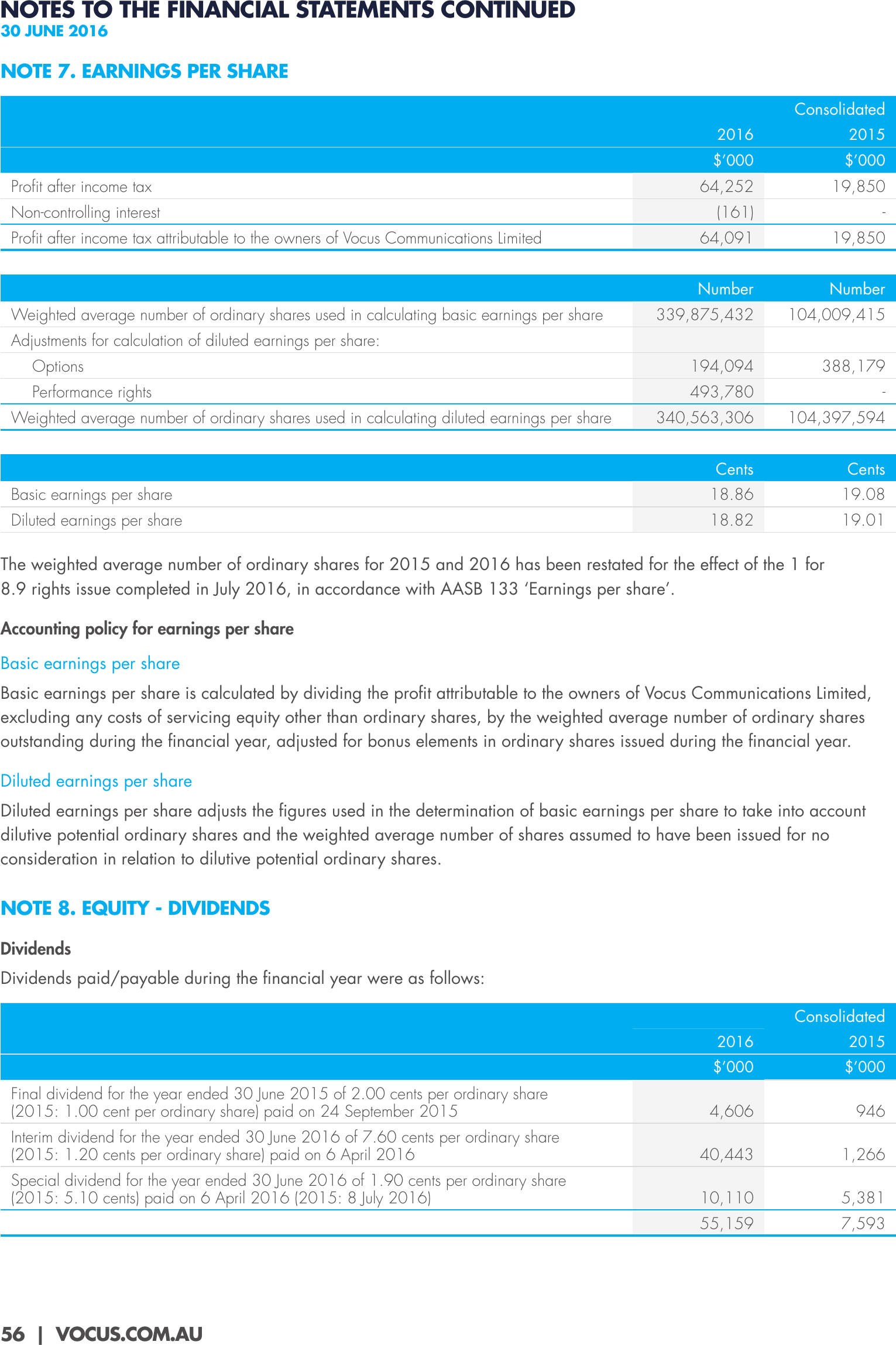

NOTE 7. EARNINGS PER SHARE

Consolidated

2016

Profit after income tax

Non-controlling interest

Profit after income tax attributable to the owners of Vocus Communications Limited

2015

$’000

$’000

64,252

19,850

(161)

-

64,091

19,850

Number

Number

339,875,432

104,009,415

Options

194,094

388,179

Performance rights

493,780

-

340,563,306

104,397,594

Weighted average number of ordinary shares used in calculating basic earnings per share

Adjustments for calculation of diluted earnings per share:

Weighted average number of ordinary shares used in calculating diluted earnings per share

Cents

Cents

Basic earnings per share

18.86

19.08

Diluted earnings per share

18.82

19.01

The weighted average number of ordinary shares for 2015 and 2016 has been restated for the effect of the 1 for

8.9 rights issue completed in July 2016, in accordance with AASB 133 ‘Earnings per share’.

Accounting policy for earnings per share

Basic earnings per share

Basic earnings per share is calculated by dividing the profit attributable to the owners of Vocus Communications Limited,

excluding any costs of servicing equity other than ordinary shares, by the weighted average number of ordinary shares

outstanding during the financial year, adjusted for bonus elements in ordinary shares issued during the financial year.

Diluted earnings per share

Diluted earnings per share adjusts the figures used in the determination of basic earnings per share to take into account

dilutive potential ordinary shares and the weighted average number of shares assumed to have been issued for no

consideration in relation to dilutive potential ordinary shares.

NOTE 8. EQUITY - DIVIDENDS

Dividends

Dividends paid/payable during the financial year were as follows:

Consolidated

2016

2015

$’000

$’000

4,606

946

Interim dividend for the year ended 30 June 2016 of 7.60 cents per ordinary share

(2015: 1.20 cents per ordinary share) paid on 6 April 2016

40,443

1,266

Special dividend for the year ended 30 June 2016 of 1.90 cents per ordinary share

(2015: 5.10 cents) paid on 6 April 2016 (2015: 8 July 2016)

10,110

5,381

55,159

7,593

Final dividend for the year ended 30 June 2015 of 2.00 cents per ordinary share

(2015: 1.00 cent per ordinary share) paid on 24 September 2015

56 | VOCUS.COM.AU

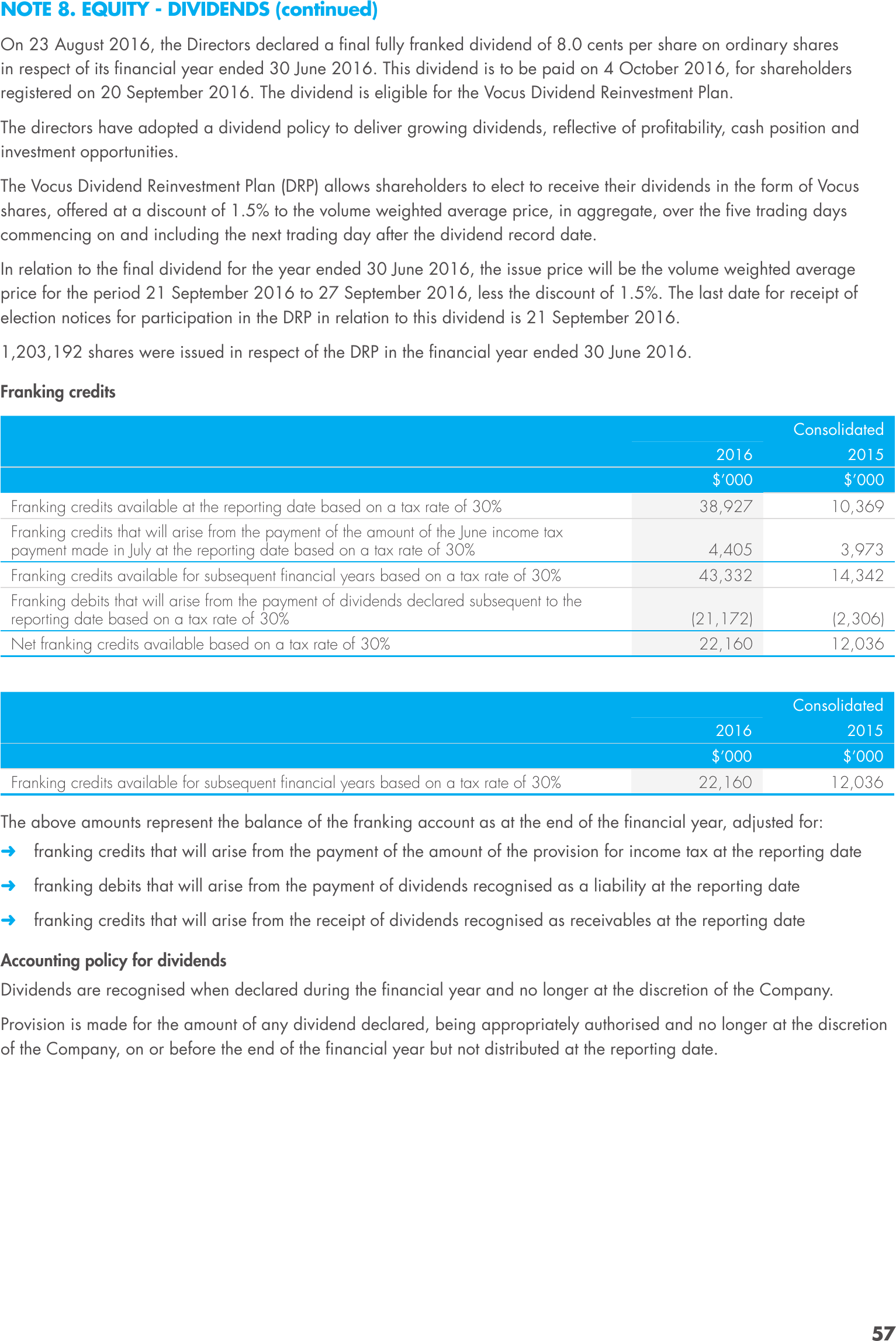

NOTE 8. EQUITY - DIVIDENDS (continued)

On 23 August 2016, the Directors declared a final fully franked dividend of 8.0 cents per share on ordinary shares

in respect of its financial year ended 30 June 2016. This dividend is to be paid on 4 October 2016, for shareholders

registered on 20 September 2016. The dividend is eligible for the Vocus Dividend Reinvestment Plan.

The directors have adopted a dividend policy to deliver growing dividends, reflective of profitability, cash position and

investment opportunities.

The Vocus Dividend Reinvestment Plan (DRP) allows shareholders to elect to receive their dividends in the form of Vocus

shares, offered at a discount of 1.5% to the volume weighted average price, in aggregate, over the five trading days

commencing on and including the next trading day after the dividend record date.

In relation to the final dividend for the year ended 30 June 2016, the issue price will be the volume weighted average

price for the period 21 September 2016 to 27 September 2016, less the discount of 1.5%. The last date for receipt of

election notices for participation in the DRP in relation to this dividend is 21 September 2016.

1,203,192 shares were issued in respect of the DRP in the financial year ended 30 June 2016.

Franking credits

Consolidated

2016

Franking credits available at the reporting date based on a tax rate of 30%

2015

$’000

$’000

38,927

10,369

Franking credits that will arise from the payment of the amount of the June income tax

payment made in July at the reporting date based on a tax rate of 30%

4,405

3,973

Franking credits available for subsequent financial years based on a tax rate of 30%

43,332

14,342

Franking debits that will arise from the payment of dividends declared subsequent to the

reporting date based on a tax rate of 30%

Net franking credits available based on a tax rate of 30%

(21,172)

(2,306)

22,160

12,036

Consolidated

2016

Franking credits available for subsequent financial years based on a tax rate of 30%

2015

$’000

$’000

22,160

12,036

The above amounts represent the balance of the franking account as at the end of the financial year, adjusted for:

➜➜ franking credits that will arise from the payment of the amount of the provision for income tax at the reporting date

➜➜ franking debits that will arise from the payment of dividends recognised as a liability at the reporting date

➜➜ franking credits that will arise from the receipt of dividends recognised as receivables at the reporting date

Accounting policy for dividends

Dividends are recognised when declared during the financial year and no longer at the discretion of the Company.

Provision is made for the amount of any dividend declared, being appropriately authorised and no longer at the discretion

of the Company, on or before the end of the financial year but not distributed at the reporting date.

57

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

30 JUNE 2016

NOTE 9. FINANCIAL INSTRUMENTS

Financial risk management objectives

Vocus’ activities expose it to a variety of financial risks including market risks such as foreign currency, price and interest

rate, and credit and liquidity risks.

The Audit Committee has general oversight of those financial risks identified here. In addition, the Risk Committee oversees

a formal risk management policy and risks identified are monitored by executive management on a regular basis to

minimise the potential adverse effects these risks may have on financial performance.

Overall risk management focuses on the unpredictability of financial markets and seeks to minimise potential adverse

effects on financial performance where material. Derivative financial instruments such as forward foreign exchange

contracts are used to hedge certain risk exposures or cash flow hedges where appropriate.

Derivatives are exclusively used for hedging purposes, i.e. not as trading or other speculative instruments, with the

exception of the total return swap in relation to Vocus’ 16% relevant interest in Macquarie Telecom Group Limited which is

held as a strategic investment.

Different methods are used to measure different types of risk to which Vocus is exposed. These methods include sensitivity

analysis in the case of interest rate, foreign exchange and other price risks and ageing analysis for credit risk.

As part of the acquisition of M2 Group Limited, Vocus now has an electricity and gas retailing business for which it

needs to manage commodity risk. The Wholesale Energy Risk Management Committee, which is a sub-committee of the

Risk Committee provides direct oversight over the risks relating to this business and appropriate hedging strategies are

undertaken to mitigate these risks.

Financial assets and liabilities comprise cash and cash equivalents, receivables, payables, bank loans and finance leases.

Market risk

Foreign currency risk

Certain transactions are denominated in foreign currency and is exposed to foreign currency risk through foreign exchange

rate fluctuations.

Foreign exchange risk arises from future commercial transactions and recognised financial assets and financial liabilities

denominated in a currency that is not the entity’s functional currency. The risk is measured using sensitivity analysis and

cash flow forecasting.

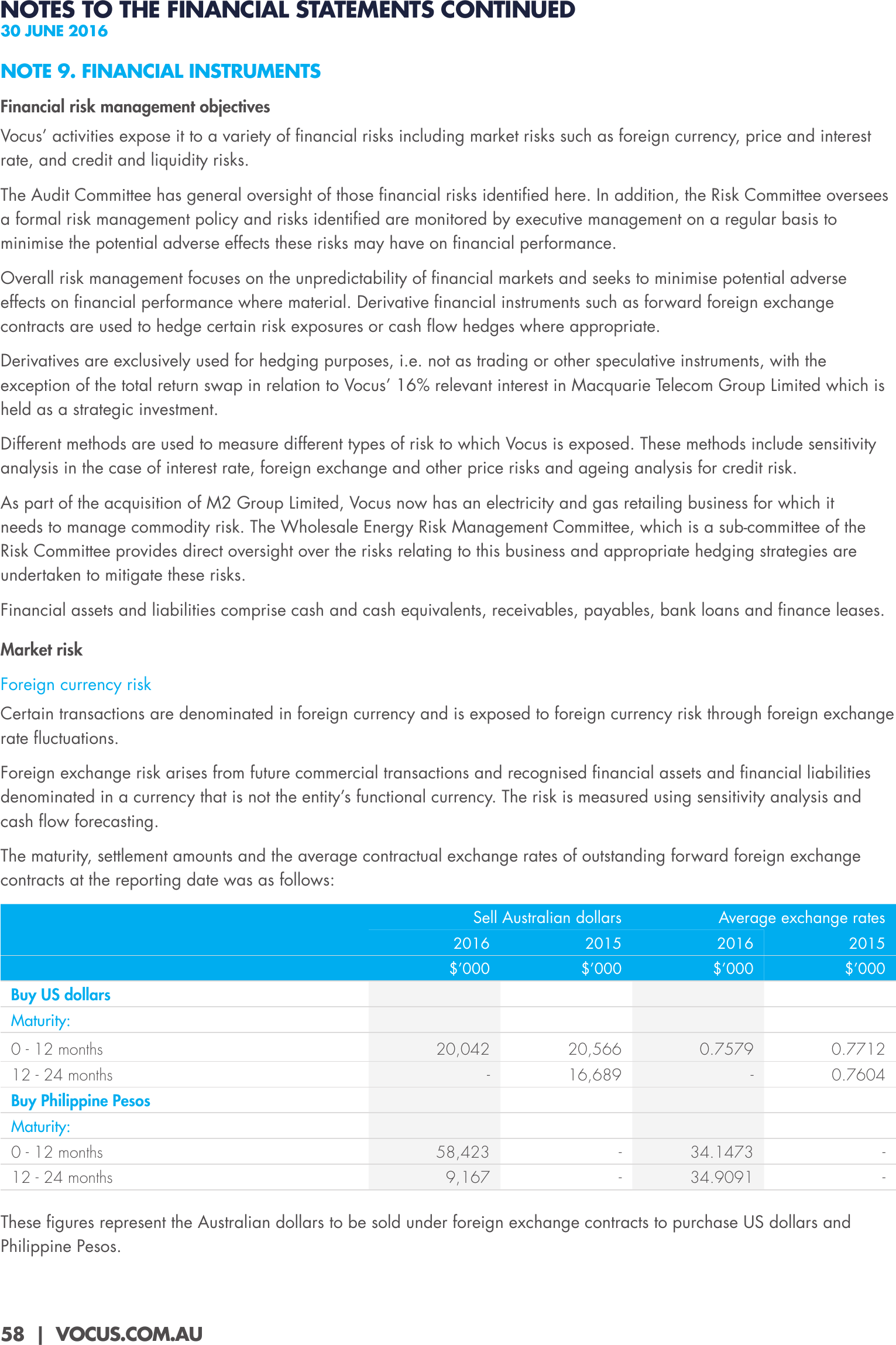

The maturity, settlement amounts and the average contractual exchange rates of outstanding forward foreign exchange

contracts at the reporting date was as follows:

Sell Australian dollars

Average exchange rates

2016

2015

2016

2015

$’000

$’000

$’000

$’000

20,042

20,566

0.7579

0.7712

-

16,689

-

0.7604

58,423

-

34.1473

-

9,167

-

34.9091

-

Buy US dollars

Maturity:

0 - 12 months

12 - 24 months

Buy Philippine Pesos

Maturity:

0 - 12 months

12 - 24 months

These figures represent the Australian dollars to be sold under foreign exchange contracts to purchase US dollars and

Philippine Pesos.

58 | VOCUS.COM.AU

NOTE 9. FINANCIAL INSTRUMENTS (continued)

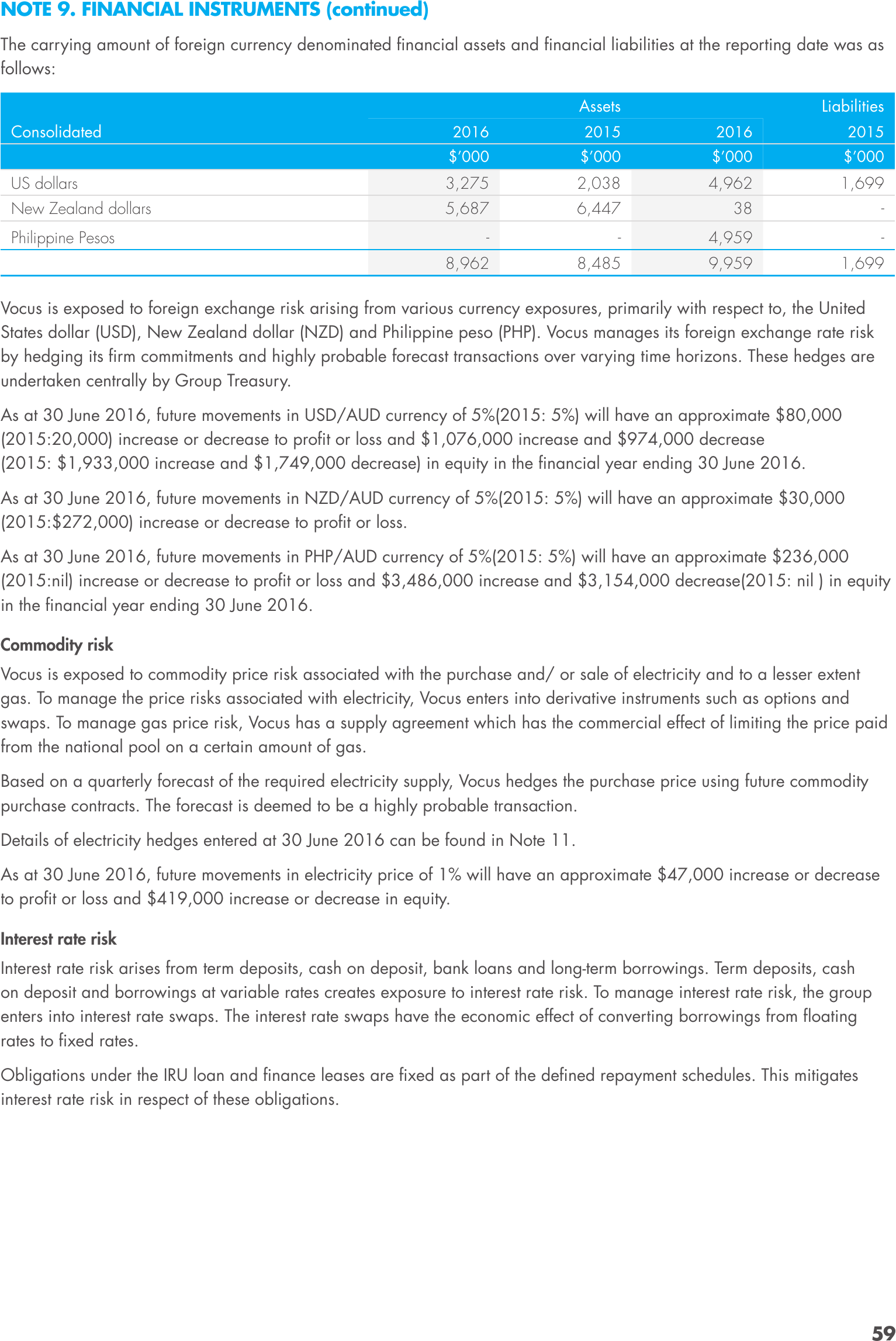

The carrying amount of foreign currency denominated financial assets and financial liabilities at the reporting date was as

follows:

Assets

Consolidated

2016

2015

Liabilities

2016

2015

$’000

$’000

$’000

$’000

US dollars

3,275

2,038

4,962

1,699

New Zealand dollars

5,687

6,447

38

-

-

-

4,959

-

8,962

8,485

9,959

1,699

Philippine Pesos

Vocus is exposed to foreign exchange risk arising from various currency exposures, primarily with respect to, the United

States dollar (USD), New Zealand dollar (NZD) and Philippine peso (PHP). Vocus manages its foreign exchange rate risk

by hedging its firm commitments and highly probable forecast transactions over varying time horizons. These hedges are

undertaken centrally by Group Treasury.

As at 30 June 2016, future movements in USD/AUD currency of 5%(2015: 5%) will have an approximate $80,000

(2015:20,000) increase or decrease to profit or loss and $1,076,000 increase and $974,000 decrease

(2015: $1,933,000 increase and $1,749,000 decrease) in equity in the financial year ending 30 June 2016.

As at 30 June 2016, future movements in NZD/AUD currency of 5%(2015: 5%) will have an approximate $30,000

(2015:$272,000) increase or decrease to profit or loss.

As at 30 June 2016, future movements in PHP/AUD currency of 5%(2015: 5%) will have an approximate $236,000

(2015:nil) increase or decrease to profit or loss and $3,486,000 increase and $3,154,000 decrease(2015: nil ) in equity

in the financial year ending 30 June 2016.

Commodity risk

Vocus is exposed to commodity price risk associated with the purchase and/ or sale of electricity and to a lesser extent

gas. To manage the price risks associated with electricity, Vocus enters into derivative instruments such as options and

swaps. To manage gas price risk, Vocus has a supply agreement which has the commercial effect of limiting the price paid

from the national pool on a certain amount of gas.

Based on a quarterly forecast of the required electricity supply, Vocus hedges the purchase price using future commodity

purchase contracts. The forecast is deemed to be a highly probable transaction.

Details of electricity hedges entered at 30 June 2016 can be found in Note 11.

As at 30 June 2016, future movements in electricity price of 1% will have an approximate $47,000 increase or decrease

to profit or loss and $419,000 increase or decrease in equity.

Interest rate risk

Interest rate risk arises from term deposits, cash on deposit, bank loans and long-term borrowings. Term deposits, cash

on deposit and borrowings at variable rates creates exposure to interest rate risk. To manage interest rate risk, the group

enters into interest rate swaps. The interest rate swaps have the economic effect of converting borrowings from floating

rates to fixed rates.

Obligations under the IRU loan and finance leases are fixed as part of the defined repayment schedules. This mitigates

interest rate risk in respect of these obligations.

59

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

30 JUNE 2016

NOTE 9. FINANCIAL INSTRUMENTS (continued)

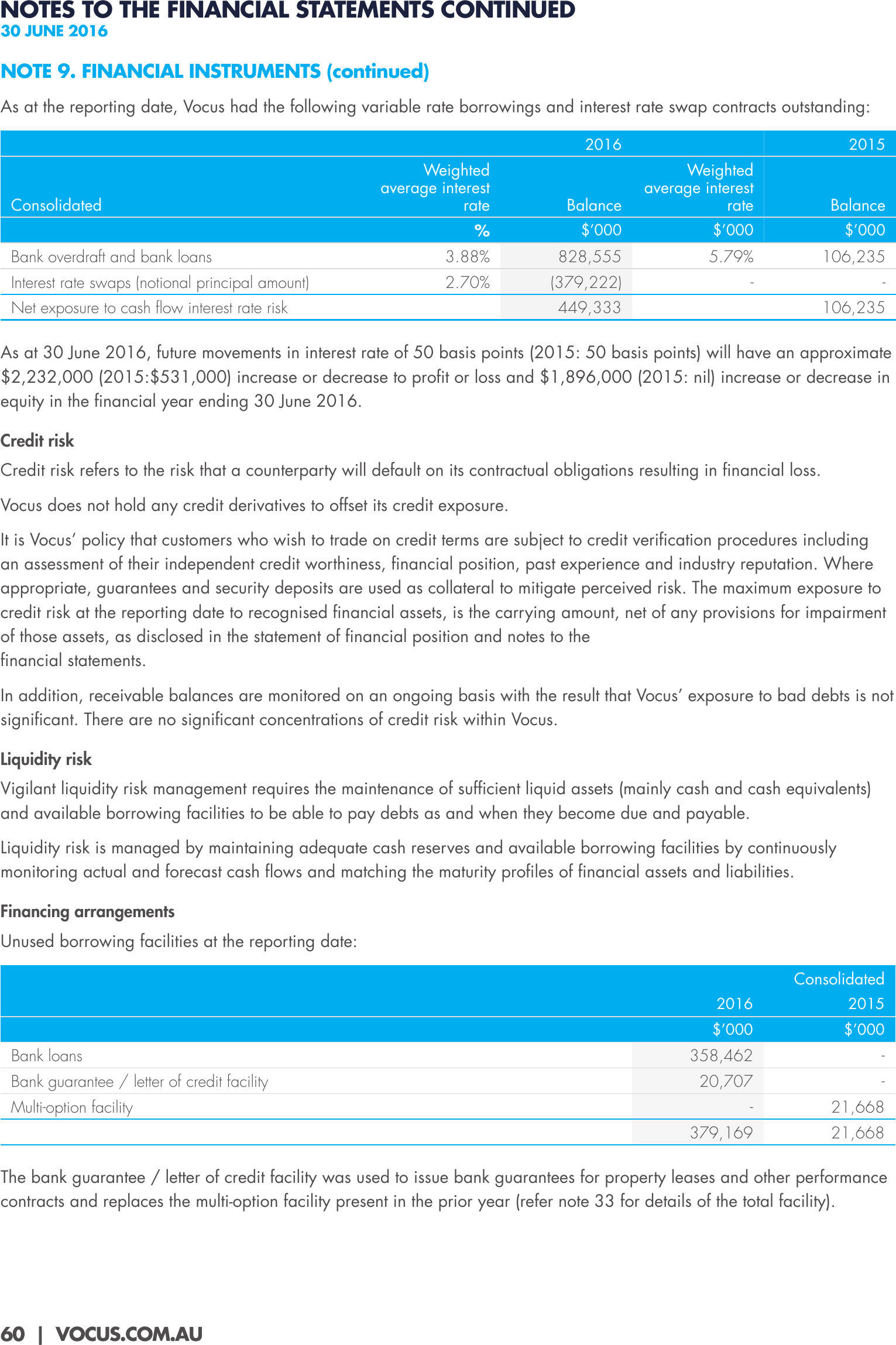

As at the reporting date, Vocus had the following variable rate borrowings and interest rate swap contracts outstanding:

2016

Consolidated

Weighted

average interest

rate

Balance

2015

Weighted

average interest

rate

Balance

%

$’000

$’000

$’000

Bank overdraft and bank loans

3.88%

828,555

5.79%

106,235

Interest rate swaps (notional principal amount)

2.70%

(379,222)

-

Net exposure to cash flow interest rate risk

-

449,333

106,235

As at 30 June 2016, future movements in interest rate of 50 basis points (2015: 50 basis points) will have an approximate

$2,232,000 (2015:$531,000) increase or decrease to profit or loss and $1,896,000 (2015: nil) increase or decrease in

equity in the financial year ending 30 June 2016.

Credit risk

Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in financial loss.

Vocus does not hold any credit derivatives to offset its credit exposure.

It is Vocus’ policy that customers who wish to trade on credit terms are subject to credit verification procedures including

an assessment of their independent credit worthiness, financial position, past experience and industry reputation. Where

appropriate, guarantees and security deposits are used as collateral to mitigate perceived risk. The maximum exposure to

credit risk at the reporting date to recognised financial assets, is the carrying amount, net of any provisions for impairment

of those assets, as disclosed in the statement of financial position and notes to the

financial statements.

In addition, receivable balances are monitored on an ongoing basis with the result that Vocus’ exposure to bad debts is not

significant. There are no significant concentrations of credit risk within Vocus.

Liquidity risk

Vigilant liquidity risk management requires the maintenance of sufficient liquid assets (mainly cash and cash equivalents)

and available borrowing facilities to be able to pay debts as and when they become due and payable.

Liquidity risk is managed by maintaining adequate cash reserves and available borrowing facilities by continuously

monitoring actual and forecast cash flows and matching the maturity profiles of financial assets and liabilities.

Financing arrangements

Unused borrowing facilities at the reporting date:

Consolidated

2016

Bank loans

2015

$’000

$’000

Multi-option facility

358,462

-

20,707

-

-

21,668

379,169

Bank guarantee / letter of credit facility

21,668

The bank guarantee / letter of credit facility was used to issue bank guarantees for property leases and other performance

contracts and replaces the multi-option facility present in the prior year (refer note 33 for details of the total facility).

60 | VOCUS.COM.AU

NOTE 9. FINANCIAL INSTRUMENTS (continued)

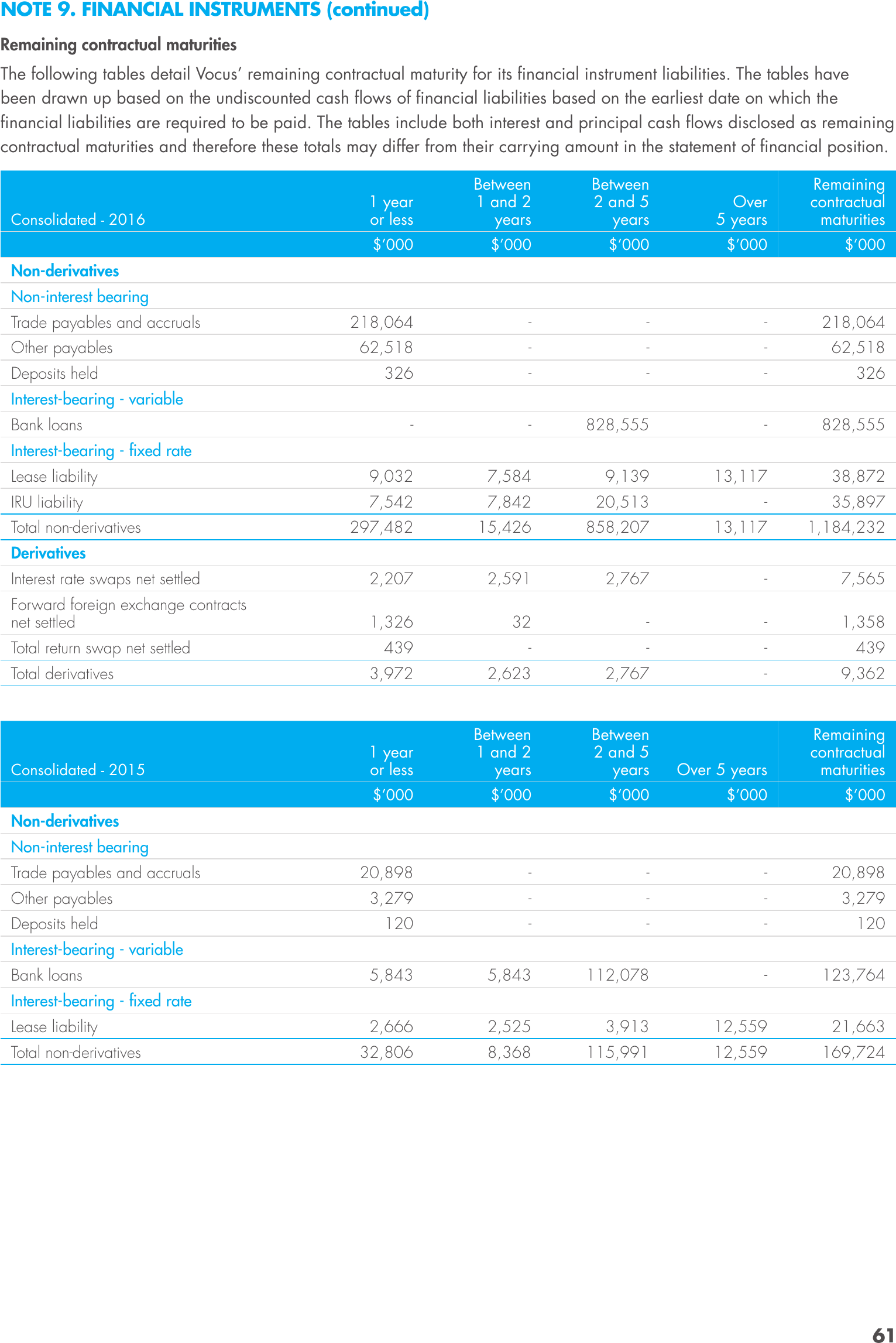

Remaining contractual maturities

The following tables detail Vocus’ remaining contractual maturity for its financial instrument liabilities. The tables have

been drawn up based on the undiscounted cash flows of financial liabilities based on the earliest date on which the

financial liabilities are required to be paid. The tables include both interest and principal cash flows disclosed as remaining

contractual maturities and therefore these totals may differ from their carrying amount in the statement of financial position.

Between

1 and 2

years

Between

2 and 5

years

Over

5 years

Remaining

contractual

maturities

$’000

Consolidated - 2016

1 year

or less

$’000

$’000

$’000

$’000

Non-derivatives

Non-interest bearing

Trade payables and accruals

Other payables

Deposits held

218,064

-

-

-

218,064

62,518

-

-

-

62,518

326

-

-

-

326

-

-

828,555

-

828,555

Interest-bearing - variable

Bank loans

Interest-bearing - fixed rate

Lease liability

9,032

7,584

9,139

13,117

38,872

IRU liability

7,542

7,842

20,513

-

35,897

297,482

15,426

858,207

13,117

1,184,232

Interest rate swaps net settled

2,207

2,591

2,767

-

7,565

Forward foreign exchange contracts

net settled

1,326

32

-

-

1,358

Total non-derivatives

Derivatives

439

-

-

-

439

Total derivatives

Total return swap net settled

3,972

2,623

2,767

-

9,362

Consolidated - 2015

1 year

or less

Between

1 and 2

years

Between

2 and 5

years

Over 5 years

Remaining

contractual

maturities

$’000

$’000

$’000

$’000

$’000

Non-derivatives

Non-interest bearing

Trade payables and accruals

Other payables

Deposits held

20,898

-

-

-

20,898

3,279

-

-

-

3,279

120

-

-

-

120

5,843

5,843

112,078

-

123,764

Interest-bearing - variable

Bank loans

Interest-bearing - fixed rate

Lease liability

Total non-derivatives

2,666

2,525

3,913

12,559

21,663

32,806

8,368

115,991

12,559

169,724

61

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

30 JUNE 2016

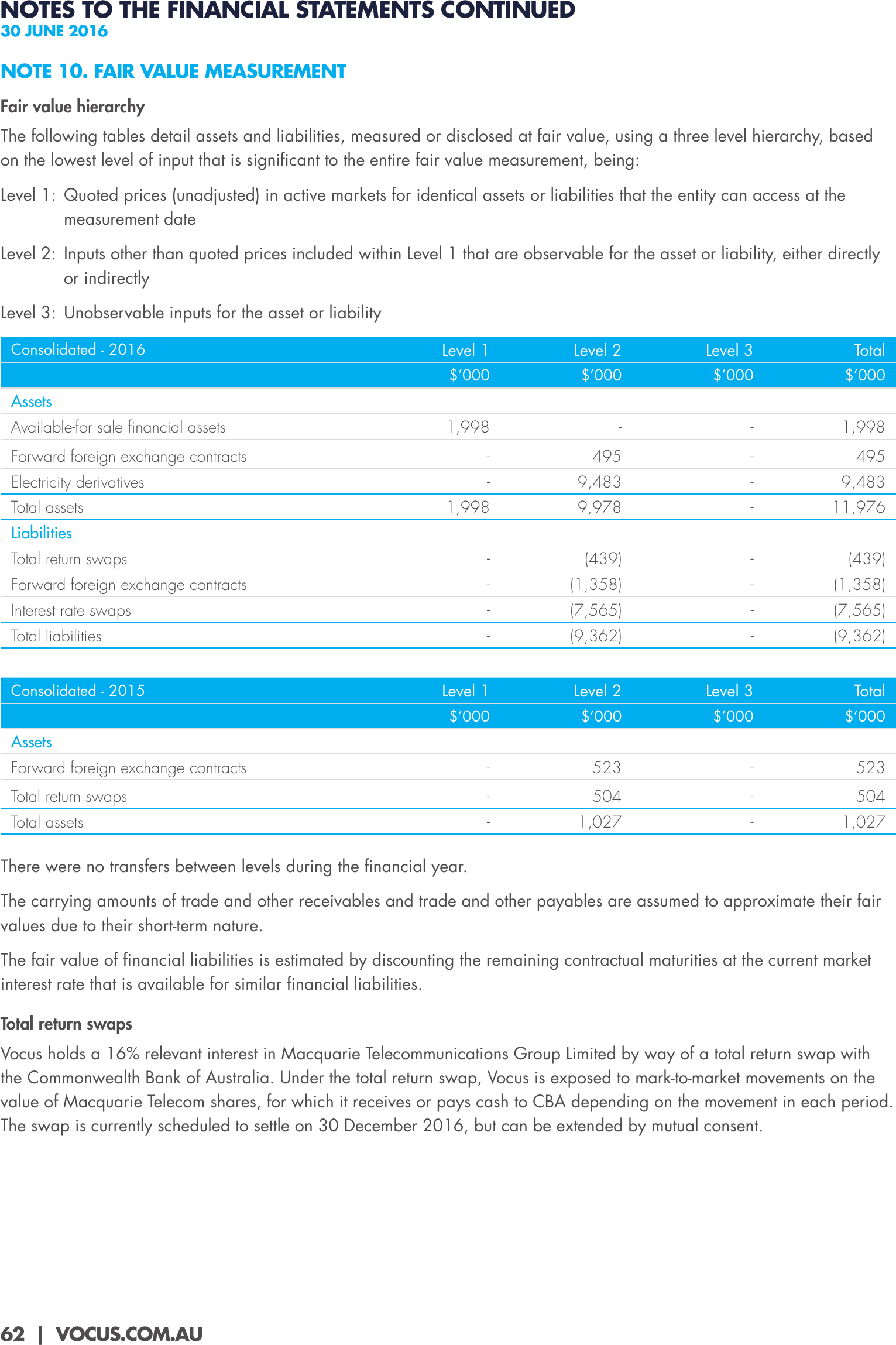

NOTE 10. FAIR VALUE MEASUREMENT

Fair value hierarchy

The following tables detail assets and liabilities, measured or disclosed at fair value, using a three level hierarchy, based

on the lowest level of input that is significant to the entire fair value measurement, being:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the

measurement date

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly

or indirectly

Level 3: Unobservable inputs for the asset or liability

Level 1

Level 2

Level 3

Total

$’000

Consolidated - 2016

$’000

$’000

$’000

1,998

-

-

1,998

Assets

Available-for sale financial assets

Forward foreign exchange contracts

-

495

-

495

Electricity derivatives

-

9,483

-

9,483

1,998

9,978

-

11,976

Total assets

Liabilities

Total return swaps

-

(439)

-

(439)

Forward foreign exchange contracts

-

(1,358)

-

(1,358)

Interest rate swaps

-

(7,565)

-

(7,565)

Total liabilities

-

(9,362)

-

(9,362)

Level 1

Level 2

Level 3

Total

$’000

$’000

$’000

$’000

Forward foreign exchange contracts

-

523

-

523

Total return swaps

-

504

-

504

Total assets

-

1,027

-

1,027

Consolidated - 2015

Assets

There were no transfers between levels during the financial year.

The carrying amounts of trade and other receivables and trade and other payables are assumed to approximate their fair

values due to their short-term nature.

The fair value of financial liabilities is estimated by discounting the remaining contractual maturities at the current market

interest rate that is available for similar financial liabilities.

Total return swaps

Vocus holds a 16% relevant interest in Macquarie Telecommunications Group Limited by way of a total return swap with

the Commonwealth Bank of Australia. Under the total return swap, Vocus is exposed to mark-to-market movements on the

value of Macquarie Telecom shares, for which it receives or pays cash to CBA depending on the movement in each period.

The swap is currently scheduled to settle on 30 December 2016, but can be extended by mutual consent.

62 | VOCUS.COM.AU

NOTE 10. FAIR VALUE MEASUREMENT (continued)

Valuation techniques for fair value measurements

Available for sale financial assets uses observable values such as publically available equity prices at the end of the

reporting period in the valuation and is classified as in the hierarchy as level 1.

The fair value of derivative financial instruments that are not traded on an active market is determined by using valuation

methodologies and assumptions that are based on market conditions existing at the valuation date. These include:

➜➜ The use of forward electricity price curve derived from various inputs such as electricity futures market is used in

calculating electricity derivatives.

➜➜ The interest rate yield curve and applying the net present value to future cash flows are techniques used in valuing

interest rate swaps.

➜➜ The fair value of forward exchange contracts are determined by using forward exchange market rates in valuing

forward exchange contracts.

➜➜ The fair value of total return swap contracts are derived from the market value of the underlying security, being the

shares of Macquarie Telecommunications Group Limited, adjusted for receipts/payments made under the swap to

balance date.

Accounting policy for fair value measurement

When an asset or liability, financial or non-financial, is measured at fair value for recognition or disclosure purposes,

the fair value is based on the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date; and assumes that the transaction will take place either:

in the principal market; or in the absence of a principal market, in the most advantageous market.

Fair value is measured using the assumptions that market participants would use when pricing the asset or liability,

assuming they act in their economic best interests. For non-financial assets, the fair value measurement is based on its

highest and best use. Valuation techniques that are appropriate in the circumstances and for which sufficient data are

available to measure fair value, are used, maximising the use of relevant observable inputs and minimising the use of

unobservable inputs.

Assets and liabilities measured at fair value are classified, into three levels, using a fair value hierarchy that reflects the

significance of the inputs used in making the measurements. Classifications are reviewed at each reporting date and

transfers between levels are determined based on a reassessment of the lowest level of input that is significant to the fair

value measurement.

For recurring and non-recurring fair value measurements, external valuer’s may be used when internal expertise is either not

available or when the valuation is deemed to be significant. External valuer’s are selected based on market knowledge and

reputation. Where there is a significant change in fair value of an asset or liability from one period to another, an analysis

is undertaken, which includes a verification of the major inputs applied in the latest valuation and a comparison, where

applicable, with external sources of data.

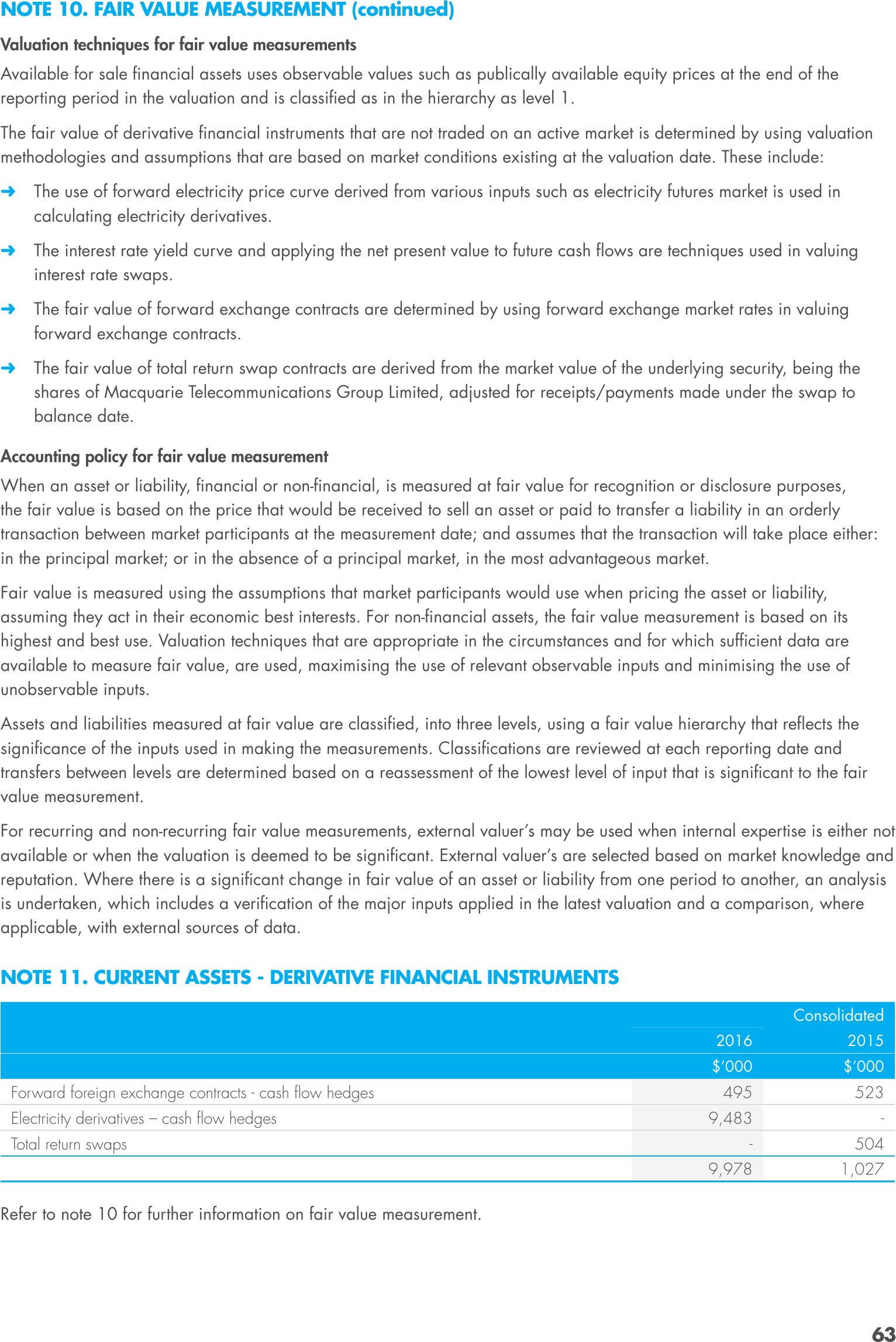

NOTE 11. CURRENT ASSETS - DERIVATIVE FINANCIAL INSTRUMENTS

Consolidated

2016

$’000

Forward foreign exchange contracts - cash flow hedges

Electricity derivatives – cash flow hedges

2015

$’000

495

523

-

-

504

9,978

Total return swaps

9,483

1,027

Refer to note 10 for further information on fair value measurement.

63

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

30 JUNE 2016

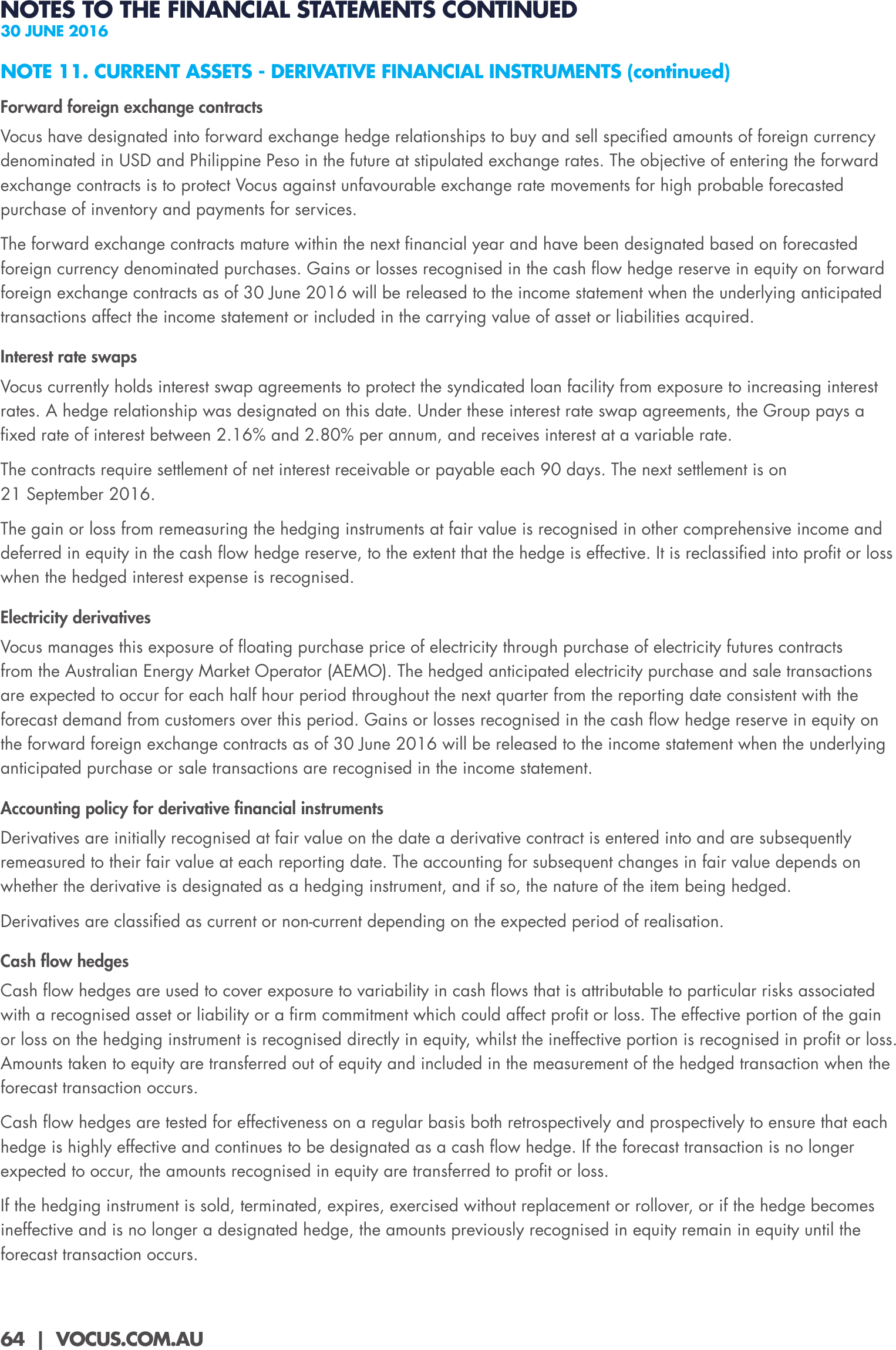

NOTE 11. CURRENT ASSETS - DERIVATIVE FINANCIAL INSTRUMENTS (continued)

Forward foreign exchange contracts

Vocus have designated into forward exchange hedge relationships to buy and sell specified amounts of foreign currency

denominated in USD and Philippine Peso in the future at stipulated exchange rates. The objective of entering the forward

exchange contracts is to protect Vocus against unfavourable exchange rate movements for high probable forecasted

purchase of inventory and payments for services.

The forward exchange contracts mature within the next financial year and have been designated based on forecasted

foreign currency denominated purchases. Gains or losses recognised in the cash flow hedge reserve in equity on forward

foreign exchange contracts as of 30 June 2016 will be released to the income statement when the underlying anticipated

transactions affect the income statement or included in the carrying value of asset or liabilities acquired.

Interest rate swaps

Vocus currently holds interest swap agreements to protect the syndicated loan facility from exposure to increasing interest

rates. A hedge relationship was designated on this date. Under these interest rate swap agreements, the Group pays a

fixed rate of interest between 2.16% and 2.80% per annum, and receives interest at a variable rate.

The contracts require settlement of net interest receivable or payable each 90 days. The next settlement is on

21 September 2016.

The gain or loss from remeasuring the hedging instruments at fair value is recognised in other comprehensive income and

deferred in equity in the cash flow hedge reserve, to the extent that the hedge is effective. It is reclassified into profit or loss

when the hedged interest expense is recognised.

Electricity derivatives

Vocus manages this exposure of floating purchase price of electricity through purchase of electricity futures contracts

from the Australian Energy Market Operator (AEMO). The hedged anticipated electricity purchase and sale transactions

are expected to occur for each half hour period throughout the next quarter from the reporting date consistent with the

forecast demand from customers over this period. Gains or losses recognised in the cash flow hedge reserve in equity on

the forward foreign exchange contracts as of 30 June 2016 will be released to the income statement when the underlying

anticipated purchase or sale transactions are recognised in the income statement.

Accounting policy for derivative financial instruments

Derivatives are initially recognised at fair value on the date a derivative contract is entered into and are subsequently

remeasured to their fair value at each reporting date. The accounting for subsequent changes in fair value depends on

whether the derivative is designated as a hedging instrument, and if so, the nature of the item being hedged.

Derivatives are classified as current or non-current depending on the expected period of realisation.

Cash flow hedges

Cash flow hedges are used to cover exposure to variability in cash flows that is attributable to particular risks associated

with a recognised asset or liability or a firm commitment which could affect profit or loss. The effective portion of the gain

or loss on the hedging instrument is recognised directly in equity, whilst the ineffective portion is recognised in profit or loss.

Amounts taken to equity are transferred out of equity and included in the measurement of the hedged transaction when the

forecast transaction occurs.

Cash flow hedges are tested for effectiveness on a regular basis both retrospectively and prospectively to ensure that each

hedge is highly effective and continues to be designated as a cash flow hedge. If the forecast transaction is no longer

expected to occur, the amounts recognised in equity are transferred to profit or loss.

If the hedging instrument is sold, terminated, expires, exercised without replacement or rollover, or if the hedge becomes

ineffective and is no longer a designated hedge, the amounts previously recognised in equity remain in equity until the

forecast transaction occurs.

64 | VOCUS.COM.AU