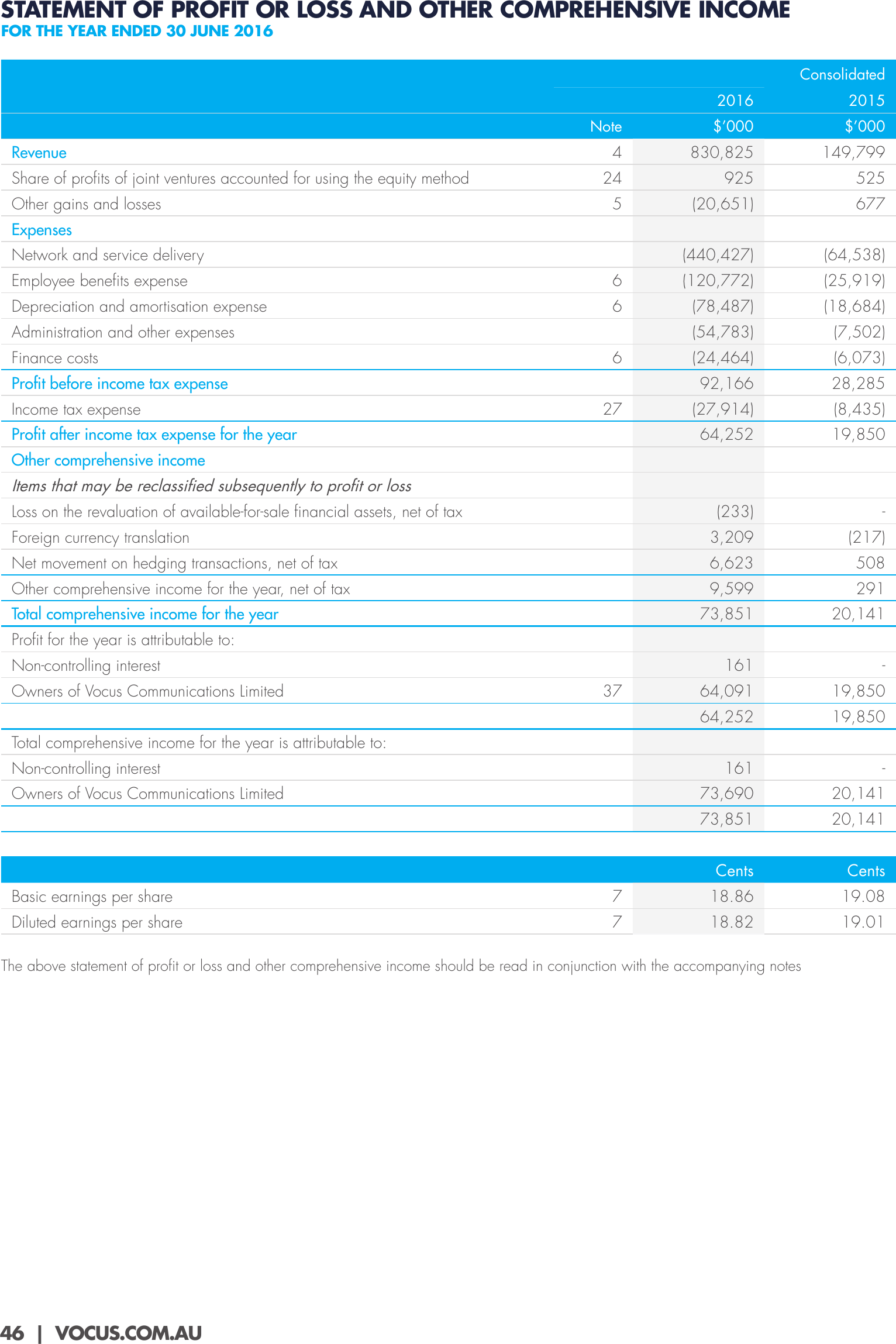

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE YEAR ENDED 30 JUNE 2016

Consolidated

2016

2015

Note

Revenue

Share of profits of joint ventures accounted for using the equity method

Other gains and losses

$’000

$’000

4

830,825

149,799

24

925

525

5

(20,651)

677

Expenses

Network and service delivery

(440,427)

(64,538)

Employee benefits expense

6

(120,772)

(25,919)

Depreciation and amortisation expense

6

(78,487)

(18,684)

(54,783)

(7,502)

Administration and other expenses

Finance costs

6

Income tax expense

27

(24,464)

(6,073)

92,166

Profit before income tax expense

28,285

(27,914)

(8,435)

64,252

19,850

(233)

-

Foreign currency translation

3,209

(217)

Net movement on hedging transactions, net of tax

6,623

508

Profit after income tax expense for the year

Other comprehensive income

Items that may be reclassified subsequently to profit or loss

Loss on the revaluation of available-for-sale financial assets, net of tax

Other comprehensive income for the year, net of tax

9,599

291

73,851

20,141

161

-

64,091

19,850

64,252

Total comprehensive income for the year

19,850

Profit for the year is attributable to:

Non-controlling interest

Owners of Vocus Communications Limited

37

Total comprehensive income for the year is attributable to:

Non-controlling interest

161

-

73,690

20,141

73,851

Owners of Vocus Communications Limited

20,141

Cents

Cents

Basic earnings per share

7

18.86

19.08

Diluted earnings per share

7

18.82

19.01

The above statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes

46 | VOCUS.COM.AU

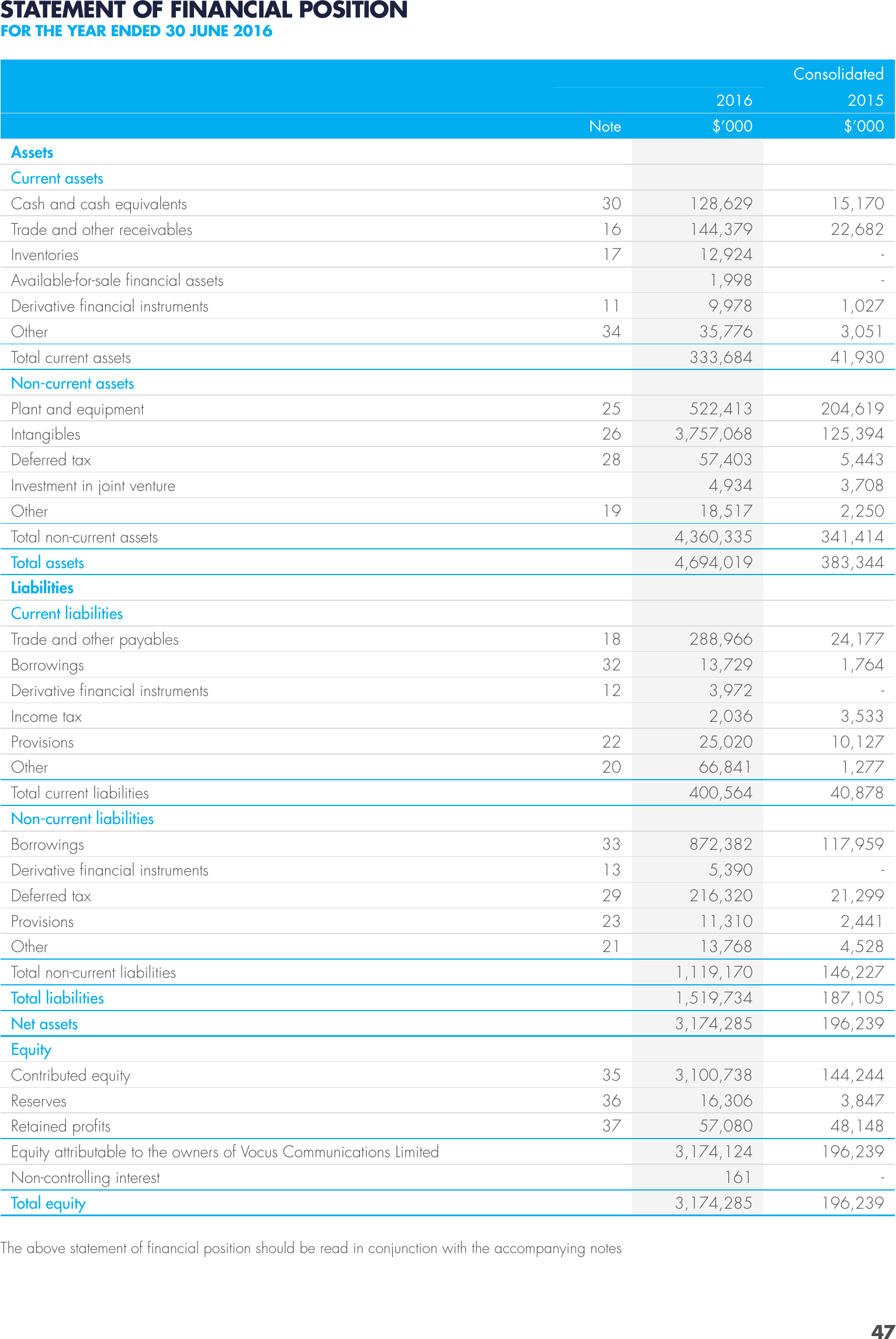

STATEMENT OF FINANCIAL POSITION

FOR THE YEAR ENDED 30 JUNE 2016

Consolidated

2016

2015

Note

$’000

$’000

Cash and cash equivalents

30

128,629

15,170

Trade and other receivables

16

144,379

22,682

Inventories

17

12,924

-

1,998

-

Assets

Current assets

Available-for-sale financial assets

Derivative financial instruments

11

9,978

1,027

Other

34

35,776

3,051

333,684

41,930

Total current assets

Non-current assets

Plant and equipment

25

522,413

204,619

Intangibles

26

3,757,068

125,394

Deferred tax

28

57,403

5,443

4,934

3,708

18,517

2,250

Total non-current assets

4,360,335

341,414

Total assets

4,694,019

383,344

Investment in joint venture

Other

19

Liabilities

Current liabilities

Trade and other payables

18

288,966

24,177

Borrowings

32

13,729

1,764

Derivative financial instruments

12

3,972

-

2,036

3,533

10,127

Income tax

Provisions

22

25,020

Other

20

66,841

1,277

400,564

40,878

872,382

117,959

Total current liabilities

Non-current liabilities

Borrowings

33

Derivative financial instruments

13

5,390

-

Deferred tax

29

216,320

21,299

Provisions

23

11,310

2,441

Other

21

13,768

4,528

Total non-current liabilities

1,119,170

146,227

Total liabilities

1,519,734

187,105

Net assets

3,174,285

196,239

144,244

Equity

Contributed equity

35

3,100,738

Reserves

36

16,306

3,847

Retained profits

37

57,080

48,148

3,174,124

196,239

161

-

3,174,285

196,239

Equity attributable to the owners of Vocus Communications Limited

Non-controlling interest

Total equity

The above statement of financial position should be read in conjunction with the accompanying notes

47

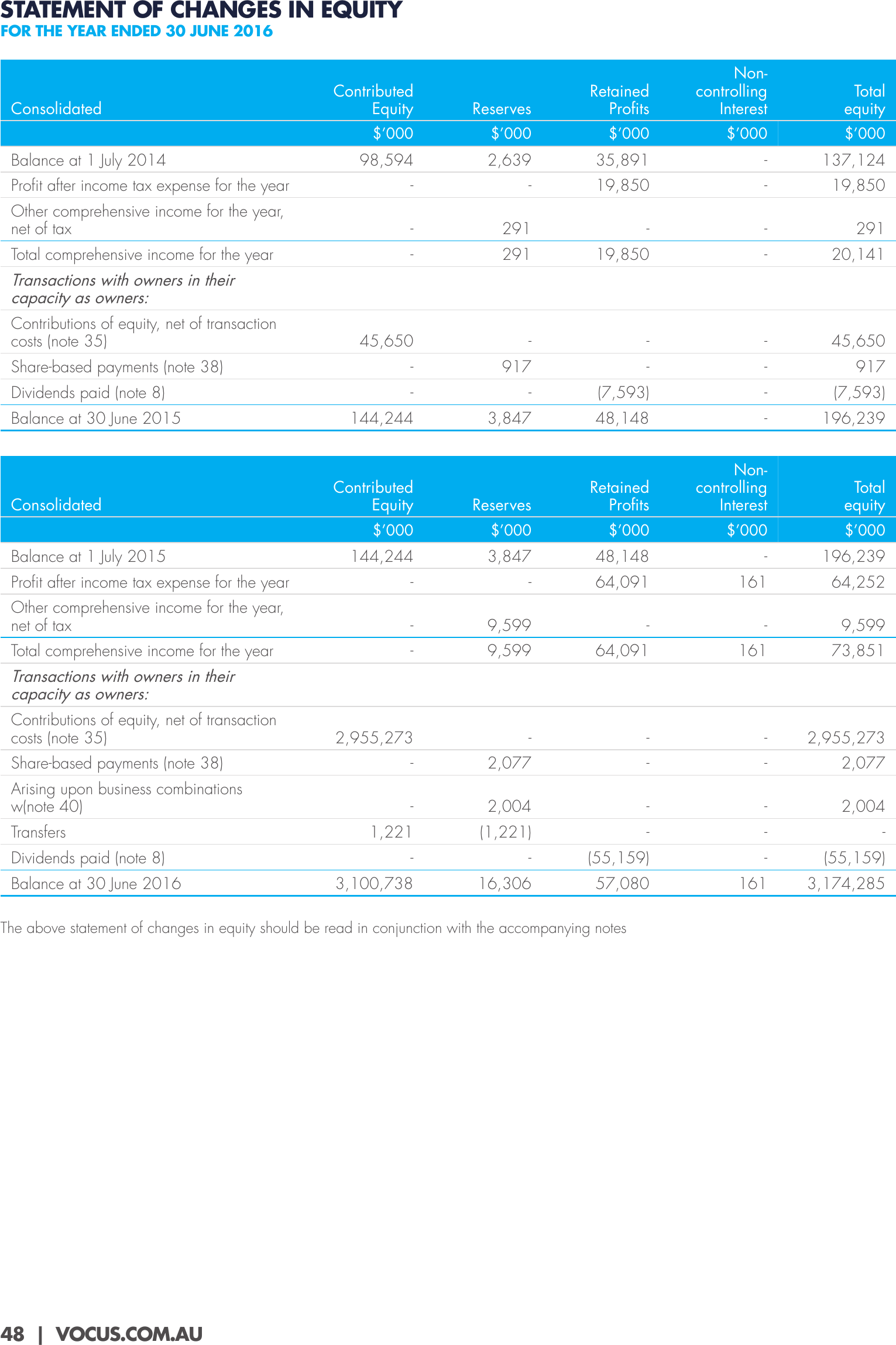

STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 30 JUNE 2016

Consolidated

Contributed

Equity

Reserves

Retained

Profits

Noncontrolling

Interest

Total

equity

$’000

Balance at 1 July 2014

$’000

$’000

$’000

$’000

98,594

2,639

35,891

-

137,124

Profit after income tax expense for the year

-

-

19,850

-

19,850

Other comprehensive income for the year,

net of tax

-

291

-

-

291

Total comprehensive income for the year

-

291

19,850

-

20,141

45,650

Transactions with owners in their

capacity as owners:

Contributions of equity, net of transaction

costs (note 35)

45,650

-

-

-

Share-based payments (note 38)

-

917

-

-

917

Dividends paid (note 8)

-

-

(7,593)

-

(7,593)

144,244

3,847

48,148

-

196,239

Reserves

Retained

Profits

Noncontrolling

Interest

Total

equity

Balance at 30 June 2015

Consolidated

Contributed

Equity

$’000

Balance at 1 July 2015

Profit after income tax expense for the year

$’000

$’000

$’000

$’000

144,244

3,847

48,148

-

196,239

-

-

64,091

161

64,252

Other comprehensive income for the year,

net of tax

-

9,599

-

-

9,599

Total comprehensive income for the year

-

9,599

64,091

161

73,851

Transactions with owners in their

capacity as owners:

Contributions of equity, net of transaction

costs (note 35)

2,955,273

-

-

-

2,955,273

Share-based payments (note 38)

-

2,077

-

-

2,077

Arising upon business combinations

w(note 40)

-

2,004

-

-

2,004

1,221

(1,221)

-

-

-

-

-

(55,159)

-

(55,159)

3,100,738

16,306

57,080

161

3,174,285

Transfers

Dividends paid (note 8)

Balance at 30 June 2016

The above statement of changes in equity should be read in conjunction with the accompanying notes

48 | VOCUS.COM.AU

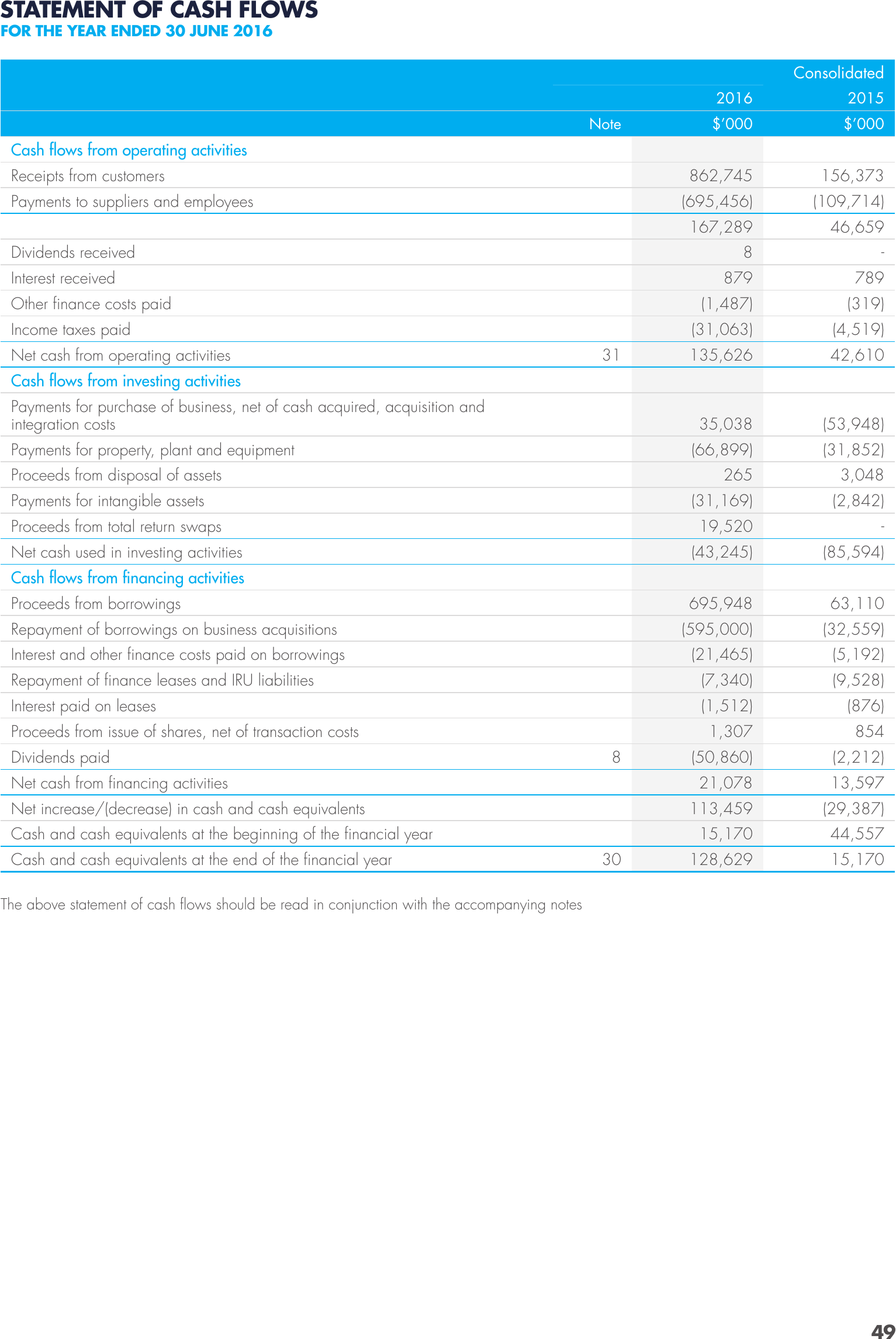

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 30 JUNE 2016

Consolidated

2016

2015

$’000

$’000

862,745

156,373

(695,456)

(109,714)

167,289

Note

46,659

Cash flows from operating activities

Receipts from customers

Payments to suppliers and employees

Dividends received

8

Other finance costs paid

789

(1,487)

(4,519)

135,626

42,610

35,038

(53,948)

(66,899)

31

(319)

(31,063)

Income taxes paid

Net cash from operating activities

-

879

Interest received

(31,852)

Cash flows from investing activities

Payments for purchase of business, net of cash acquired, acquisition and

integration costs

Payments for property, plant and equipment

Proceeds from disposal of assets

265

Proceeds from total return swaps

3,048

(31,169)

Payments for intangible assets

(2,842)

19,520

-

(43,245)

Net cash used in investing activities

(85,594)

Cash flows from financing activities

Proceeds from borrowings

695,948

Interest and other finance costs paid on borrowings

63,110

(595,000)

Repayment of borrowings on business acquisitions

(32,559)

(21,465)

(5,192)

Repayment of finance leases and IRU liabilities

(7,340)

(9,528)

Interest paid on leases

(1,512)

(876)

1,307

854

Proceeds from issue of shares, net of transaction costs

Dividends paid

8

Cash and cash equivalents at the end of the financial year

30

(29,387)

15,170

Cash and cash equivalents at the beginning of the financial year

(2,212)

13,597

113,459

Net increase/(decrease) in cash and cash equivalents

(50,860)

21,078

Net cash from financing activities

44,557

128,629

15,170

The above statement of cash flows should be read in conjunction with the accompanying notes

49