DIRECTORS

REPORT.

The directors present their report, together with the financial statements, on Vocus (referred to

hereafter as the ‘Consolidated Entity’ or ‘Vocus’) consisting of Vocus Communications Limited

(referred to hereafter as the ‘Company’ or ‘Parent Entity’) and the entities it controlled for the

year ended 30 June 2016.

Our Board of Directors at 30 June 2016: Craig Farrow, Jon Brett, Tony Grist, David Spence,

James Spenceley, Rhoda Phillippo, Michael Simmons, Vaughan Bowen

________

14 | VOCUS.COM.AU

DIRECTORS

David Spence

Vaughan Bowen

B.Com, CA (SA)

B.Comm (UNSW)

David has been involved in over 20 internet businesses,

as Chairman, Chief Executive Officer (‘CEO’), director,

shareholder or advisor. Until February 2010, David

held the role of CEO at Unwired Ltd. From 1995 until

2000, David held various positions with OzEmail,

including Managing Director and CEO. He grew the

business to become Australia’s second largest ISP.

David is a past Chairman of the Board of the Internet

Industry Association.

Vaughan co-founded M2 in late 1999, was appointed

Managing Director upon incorporation, and steered M2

from a start-up technology enterprise to a large scale,

fast-growing and profitable national telecommunications

company. Vaughan transitioned from the Managing

Director / Chief Executive Officer role into the role of

Executive Director in October 2011, following a 12

year period leading M2.

Non-Executive Chairman

Other current directorships: SAI Global Limited, Hills

Limited and PayPal Australia Pty Limited (unlisted)

Former directorships (last 3 years): None

Special responsibilities: Member of Nomination and

M&A and Strategy Committees

Craig Farrow

Non-Executive Deputy Chairman

B. Ec., Dip. FS, CPMgr, SA Fin, FCAANZ, FAICD

Craig is Chairman/Partner of Brentnalls SA, Chartered

Accountants and former National Chairman of the

Brentnalls National Affiliation of Accounting Firms.

In 2012, Craig held the position of President of the

Institute of Chartered Accountants in Australia and

in 2013, he was Executive Chair of the CAANZ

amalgamation project for ICAA and NZICA.

Currently, Craig acts as a director and Board adviser

to several private consulting and trading enterprises

across the agribusiness, software and manufacturing

sectors. Formerly Chairman of the Institute of Chartered

Accountant’s Public Practice Advisory Committee,

Craig is also highly awarded, including being a

Fellow of the Governor’s Leadership Foundation and

receiving the Institute of Chartered Accountants 1999

National President’s Award for services to the Institute

and the profession.

Executive Director

In his role as Executive Director at Vocus following its

merger with M2, Vaughan’s focus is on identifying

and executing strategic acquisition opportunities,

which, prior to the merger, included a number of

transformational acquisitions, including Primus Telecom,

Dodo and New Zealand based Call Plus Group.

Vaughan is a member of the Australian Institute of

Company Directors, was named as a finalist in the

Entrepreneur of the Year Southern Region in 2004

and 2009 and in 2012 was awarded ACOMMS

Communications Ambassador for outstanding

contributions to the telecommunications industry.

Vaughan is also Chairman of the Telco Together

Foundation, a charitable foundation unifying

the telecommunications industry in support of

disadvantaged communities, which he created and

seeded in 2011.

Other current directorships: None

Former directorships (last 3 years): None

Special responsibilities: Member of M&A and

Strategy Committee

Other current directorships: None

Former directorships (last 3 years): None

Special responsibilities: Chair of Remuneration

Committee and Member of Nomination and M&A and

Strategy Committees

15

Jon Brett

Michael Simmons

B.Acc, B.Com, MCom, CA (SA)

B. Comm, FCPA, ACIS

Jon has extensive experience in the areas of

management, operations, finance and corporate

advisory. Jon’s experience includes several years

as managing director of a number of publicly listed

companies and was also formerly the non-executive

deputy president of the National Roads and Motoring

Association. Jon is currently on the board of several

unlisted companies and was a director of Investec

Wentworth Private Equity Limited. In the mid 1990’s,

Jon was the CEO of Techway Limited which pioneered

internet banking in Australia.

Michael brings to the Board considerable experience in

the telecommunications sector, having been a member

of the M2 Group Ltd Board and having previously held

the position of Chief Executive Officer of ASX-listed

SP Telemedia Limited (“SPT Group”, now known as

TPG Telecom Limited) since its listing in 2001. Prior to

listing, the SPT Group was a wholly owned Subsidiary

of the Washington H. Soul Pattinson Limited controlled

NBN Television Group. He served in executive roles

for nearly 26 years within the SPT/NBN Group of

Companies, including as Chief Financial Officer and

Chief Executive Officer.

Non-Executive Director

Other current directorships: The PAS Group Limited

Former directorships (last 3 years): Godfreys Group Limited

Special responsibilities: Chair of Audit Committee and

Member of Risk Committee

Rhoda Phillippo

Non-Executive Director

M. Sc, AICD

Rhoda is a globally experienced executive with more

than 30 years’ experience in the telecommunications

and IT sectors, including senior management positions

in commercial, engineering and operations with British

Telecom PLC; as CEO of Optimisation New Zealand,

a software development business; and as General

Manager of Telecom/Gen-i’s (now “Spark”) enterprise

Trans-Tasman business.

Rhoda’s experience in the energy industry includes a

role as Transition Director with Shell in New Zealand

(now Z Energy) for H.R.L. Morrison & Co and recently as

Managing Director of Infratil Energy Australia, leading

the successful sale of the business in September 2014.

Rhoda was previously COO of HRL Morrison & Co. She

is currently Executive Chair of Vix Technology, Chair of

Snapper Services Ltd and a non-Executive director on the

Board of Vix Investments, Kiwibank and Ling. She is also

an Alternate Director for the Future Fund’s investment in

Perth Airport.

Other current directorships: None

Former directorships (last 3 years): None

Special responsibilities: Chair of Risk Committee,

Chair of Wholesale Energy Risk Management

Sub-committee and member of Remuneration

Committee.

16 | VOCUS.COM.AU

Non-Executive Director

In 2009 Michael left TPG Telecom to become the

Managing Director of TERRiA, a telecommunications

consortium of infrastructure-based telecommunications

carriers, formed to bid for the contract to build, own

and operate the National Broadband Network. Michael

has and continues to be a Shareholder, Director and/

or Adviser to a number of companies operating

predominantly in the telecommunications, technology

and media industry sectors.

Other current directorships: Non-Executive Director of

Aggregato Global Limited, a public, unlisted company.

Former directorships (last 3 years): None

Special responsibilities: Member of Risk and Audit

Committees

James Spenceley

Executive Director

James Spenceley is the founder of Vocus. As the

company’s leading straightshooter, James has steered

Vocus through exponential growth in a business

environment that itself has gone through seismic

change. James is a well-respected and awarded

entrepreneur having twice won the Australian

Entrepreneur of the Year Award (Young and Listed

categories). James is the archetypal maverick.

Never afraid to challenge the industry, he’s won

the trust and respect of the business and financial

community with his open, transparent and refreshingly

straightforward approach to business dealings.

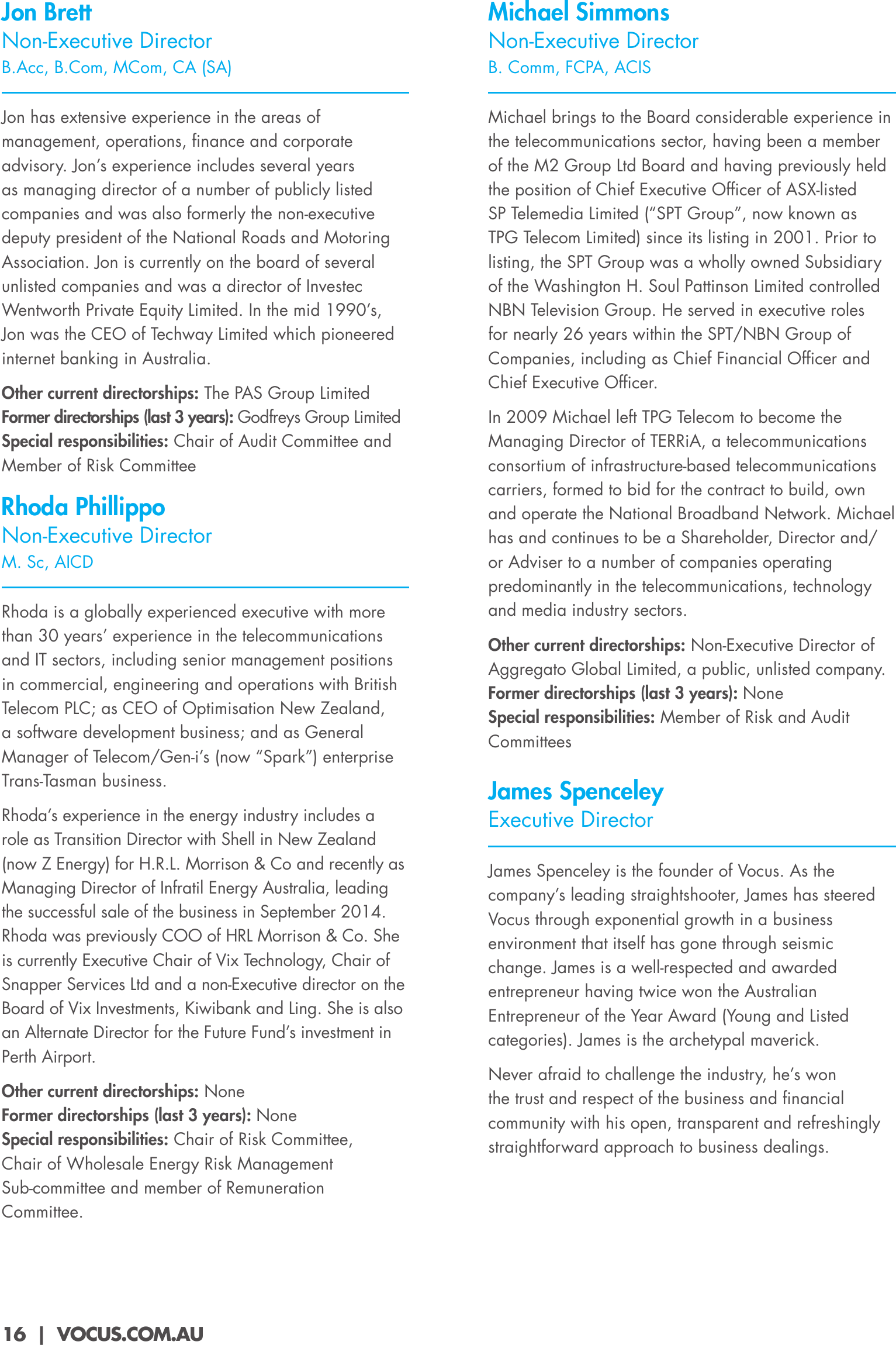

Sara Fidock, Recruitment &

HR Consultant

________

A genuine industry innovator because he believes

in the critical importance of the network and its role

in transforming business. He’s a popular speaker at

industry events around the Asia Pacific region and is

a passionate advocate for ‘doing everything better.’

James is an elected member of the APNIC Executive

Council, the body responsible for oversight of Internet

address resources in Asia Pacific.

He is an active investor in start-up businesses and

is passionate about assisting the next generation of

Australian entrepreneurs to reach their potential.

Other current directorships: None

Former directorships (last 3 years): None

Special responsibilities: Member of M&A and

Strategy Committee

Tony Grist

Non-Executive Director

B. Comm, FINSIA, FAICD

After managing the corporate underwriting division

of an Australian Stockbroking firm, Tony formed what

became Albion Capital Partners, a private investment

group based in Perth in 1991. He formed what

became Amcom Telecommunications Ltd in 1999 to

acquire and finance the then start up telco, Amcom Pty

Ltd. Tony led the acquisition of a major stake in iiNet

Limited by Amcom in 2006 and joined the board of

iiNet the same year. iiNet became the second largest

broadband provider by customer number after a major

period of expansion, and in 2011 Amcom divested its

stake in iiNet via a distribution of the stake to Amcom

shareholders. Tony left the board of iiNet in September

2011.

Other current directorships: None

Former directorships (last 3 years): Ore Corp Ltd

(formerly Silverstone Resources Limited)

Special responsibilities: Chair of Corporate Activity

Committee and Member of Audit and Remuneration

Committees

‘Other current directorships’ quoted above are current directorships

for listed entities only and excludes directorships in all other types of

entities, unless otherwise stated.

‘Former directorships (in the last 3 years)’ quoted above are

directorships held in the last 3 years for listed entities only and excludes

directorships in all other types of entities, unless otherwise stated.

James Spenceley and Tony Grist both resigned from the Vocus Board of

Directors on 11 October 2016.

17

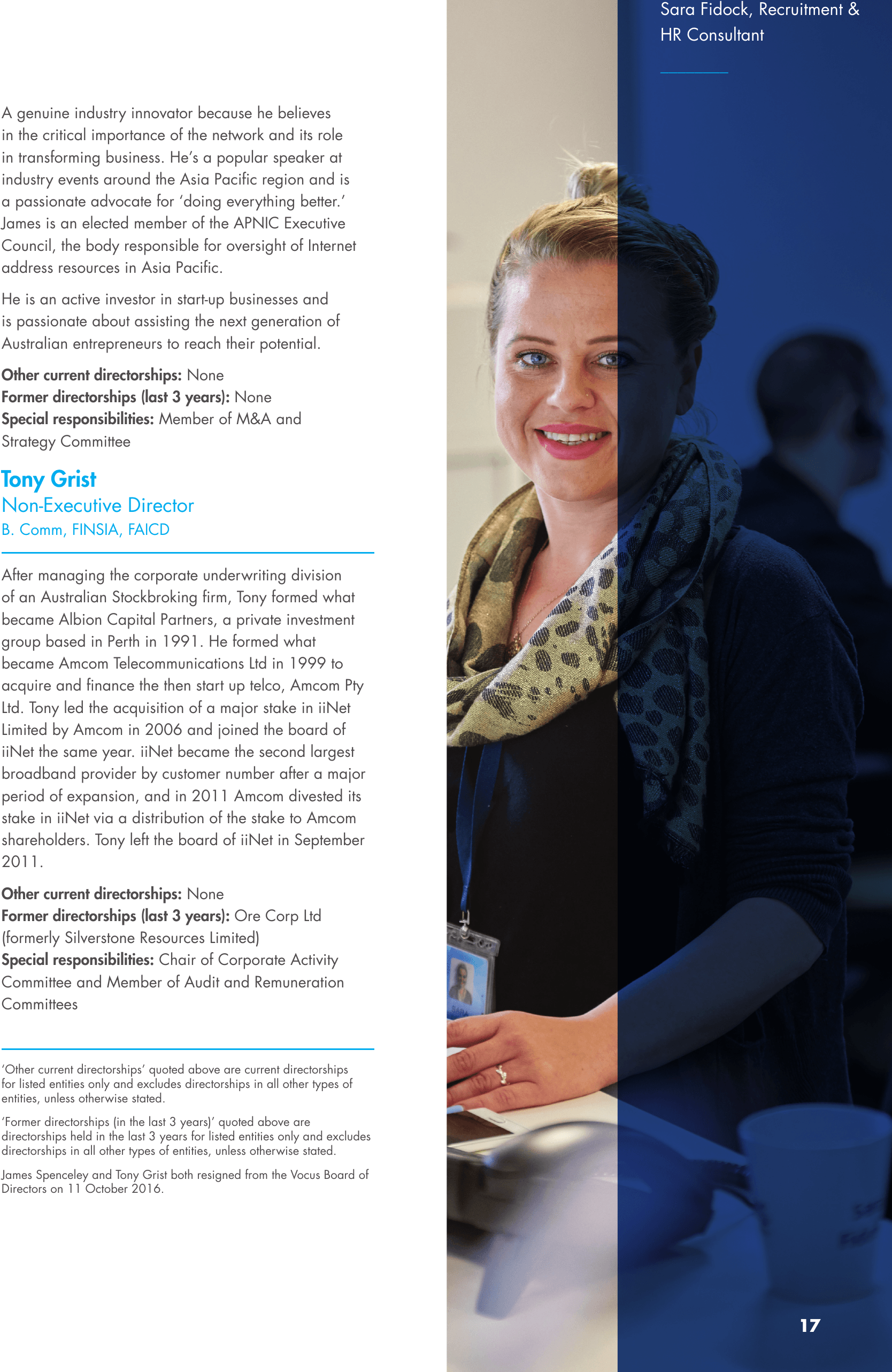

The following persons were Directors of Vocus Communications Limited during the whole of the financial year and up to

23 August 2016, unless otherwise stated:

David Spence

Non-Executive Chairman

Craig Farrow

Non-Executive Deputy Chairman (appointed 22 February 2016)

Vaughan Bowen

Executive Director (appointed 22 February 2016)

James Spenceley

Executive Director

Jon Brett

Non-Executive Director

Tony Grist

Non-Executive Director (appointed 8 July 2015)

Rhoda Phillippo

Non-Executive Director (appointed 22 February 2016)

Michael Simmons

Non-Executive Director (appointed 22 February 2016)

Steve Baxter

Former Non-Executive Director (resigned 22 February 2016)

Paul Brandling

Former Non-Executive Director (appointed 8 July 2015, resigned 22 February 2016)

Anthony Davies

Former Non-Executive Director (appointed 8 July 2015, resigned 22 February 2016)

Nick McNaughton Former Non-Executive Director (resigned 8 July 2015)

John Murphy

Former Non-Executive Director (resigned 22 February 2016)

MEETINGS OF DIRECTORS

The number of meetings of the Company’s Board of Directors (‘the Board’) and of each Board committee held during the

year ended 30 June 2016, and the number of meetings attended by each Director were:

Full Board

Attended

Held

Audit Attended

Held

Risk Attended

Held

D. Spence

18

18

-

-

-

-

C. Farrow

7

7

-

-

-

-

V. Bowen

7

7

-

-

-

-

J.Spenceley

18

18

-

-

-

-

J. Brett

18

18

2

2

3

3

T. Grist

18

18

1

1

1

2

7

7

-

-

3

3

R. Phillippo

M. Simmons

7

7

1

1

3

3

S. Baxter

10

11

-

-

3

3

P. Brandling

9

11

-

-

-

-

A. Davies

11

11

1

1

3

3

J. Murphy

11

11

1

1

1

1

Nomination

Attended

Held

Remuneration

Attended

Held

Corporate

Activity Attended

Held

D. Spence

2

2

-

-

3

3

C. Farrow

2

2

3

3

2

3

V. Bowen

-

-

-

-

3

3

J.Spenceley

-

-

-

-

3

3

J. Brett

-

-

1

2

-

-

T. Grist

-

-

3

3

3

3

R. Phillippo

-

-

3

3

-

-

P. Brandling

-

-

2

2

-

-

J. Murphy

-

-

2

2

-

-

Held: represents the number of meetings held during the time the Director held office or was a member of the

relevant committee.

18 | VOCUS.COM.AU

PRINCIPAL ACTIVITIES

Vocus Communications Limited (“Vocus”, ASX: VOC)

is a vertically integrated telecommunications provider,

providing telecommunications and other services to

customers across Australia and New Zealand.

In July 2015, Vocus acquired Amcom

Telecommunications Limited (‘Amcom’) which combined

Amcom’s fibre network on the west coast of Australia

with Vocus’ east coast networks, creating a true national

alternative to the incumbent telcos.

In February 2016, Vocus merged with M2 Group Ltd

(‘M2’), to create the fourth largest telco in Australia

and the third largest in New Zealand, with revenues of

approximately $1.8 billion. The merger takes Vocus into

supply of broadband, fixed voice, mobile, data centre,

cloud and energy services to consumer and business

segments through the well-recognised Commander,

Dodo and iPrimus brands in Australia and Slingshot,

CallPlus and Orcon in New Zealand.

COMPANY SECRETARY

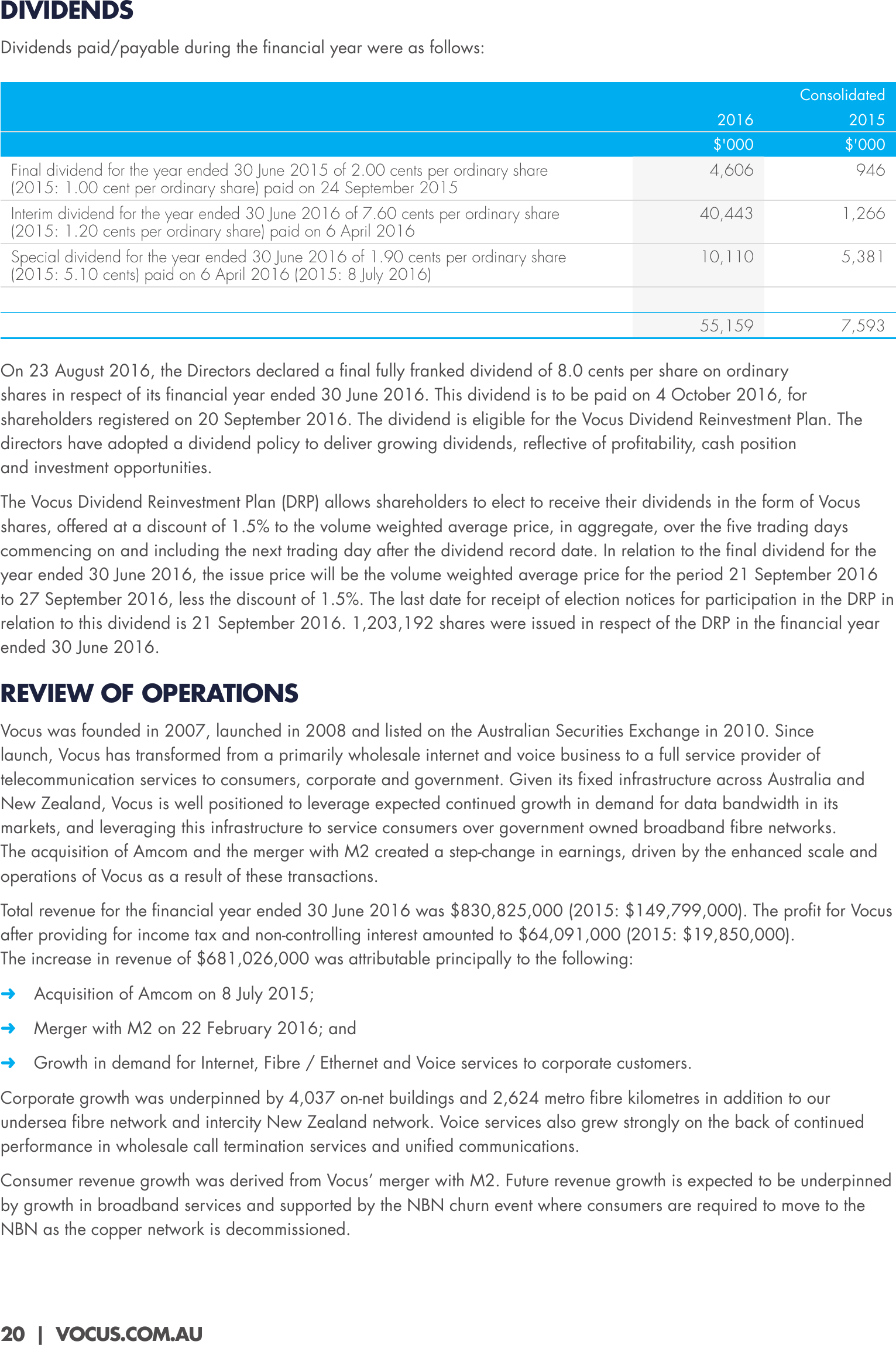

Ashe-lee Jegathesan

Company Secretary

GAICD

Ashe-lee Jegathesan, Company Secretary

________

Ashe-lee Jegathesan, GAICD, is General Counsel and

Company Secretary.

She has held this position since 22 February 2016,

having held the equivalent position with M2 Group Ltd

prior to its merger with Vocus.

Ashe-lee is responsible for the legal, regulatory

governance and risk management functions across

Vocus, as well as acting as Company Secretary to the

Board.

Ashe-lee comes to Vocus with more than 20 years’

experience as a lawyer, including in similar senior

executive roles with global companies, such as

Melbourne IT Limited (also listed on the ASX) and the

Planet One Group, and with major commercial law

firms in Australia.

19

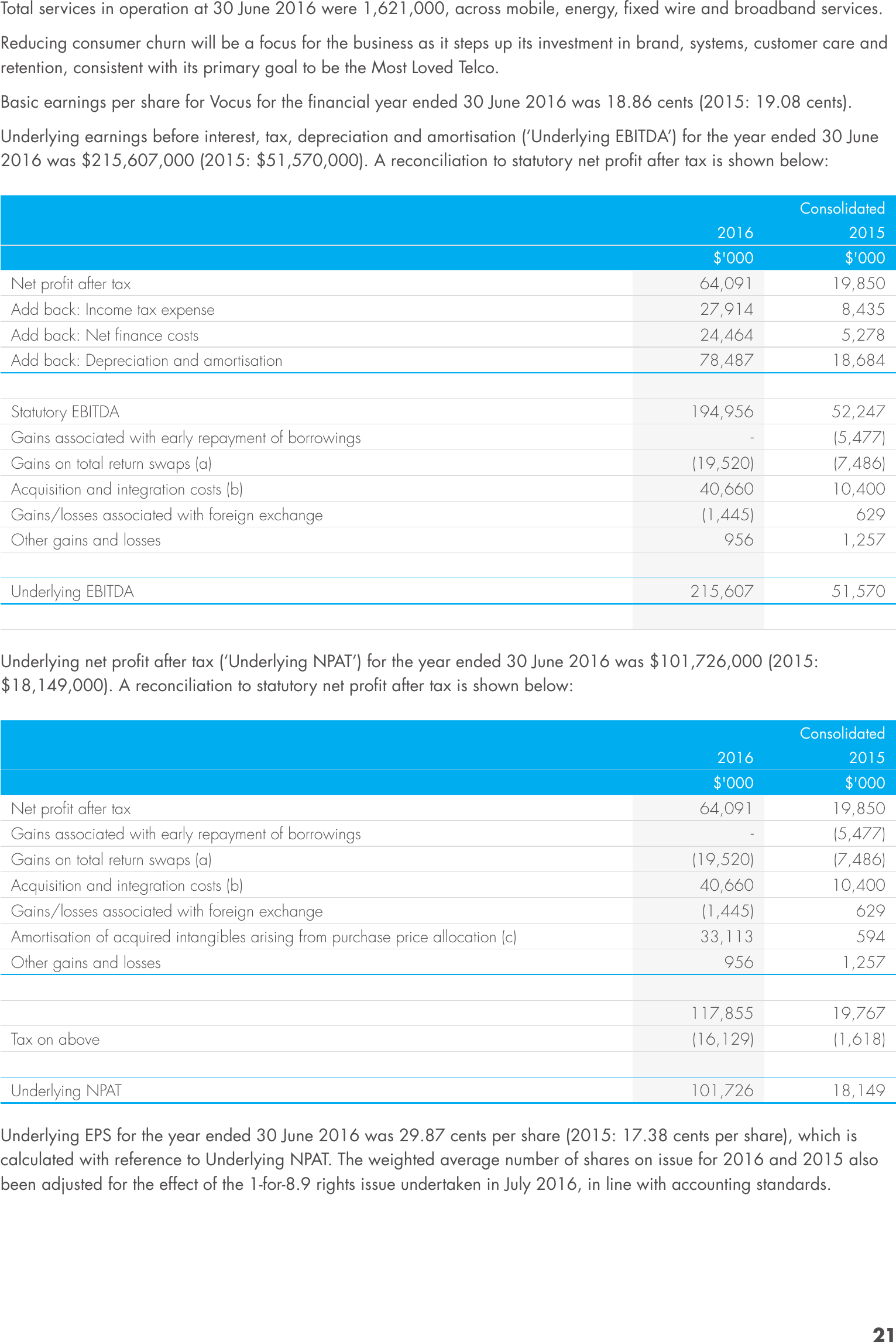

DIVIDENDS

Dividends paid/payable during the financial year were as follows:

Consolidated

2016

2015

$'000

$'000

4,606

946

Interim dividend for the year ended 30 June 2016 of 7.60 cents per ordinary share

(2015: 1.20 cents per ordinary share) paid on 6 April 2016

40,443

1,266

Special dividend for the year ended 30 June 2016 of 1.90 cents per ordinary share

(2015: 5.10 cents) paid on 6 April 2016 (2015: 8 July 2016)

10,110

5,381

55,159

7,593

Final dividend for the year ended 30 June 2015 of 2.00 cents per ordinary share

(2015: 1.00 cent per ordinary share) paid on 24 September 2015

On 23 August 2016, the Directors declared a final fully franked dividend of 8.0 cents per share on ordinary

shares in respect of its financial year ended 30 June 2016. This dividend is to be paid on 4 October 2016, for

shareholders registered on 20 September 2016. The dividend is eligible for the Vocus Dividend Reinvestment Plan. The

directors have adopted a dividend policy to deliver growing dividends, reflective of profitability, cash position

and investment opportunities.

The Vocus Dividend Reinvestment Plan (DRP) allows shareholders to elect to receive their dividends in the form of Vocus

shares, offered at a discount of 1.5% to the volume weighted average price, in aggregate, over the five trading days

commencing on and including the next trading day after the dividend record date. In relation to the final dividend for the

year ended 30 June 2016, the issue price will be the volume weighted average price for the period 21 September 2016

to 27 September 2016, less the discount of 1.5%. The last date for receipt of election notices for participation in the DRP in

relation to this dividend is 21 September 2016. 1,203,192 shares were issued in respect of the DRP in the financial year

ended 30 June 2016.

REVIEW OF OPERATIONS

Vocus was founded in 2007, launched in 2008 and listed on the Australian Securities Exchange in 2010. Since

launch, Vocus has transformed from a primarily wholesale internet and voice business to a full service provider of

telecommunication services to consumers, corporate and government. Given its fixed infrastructure across Australia and

New Zealand, Vocus is well positioned to leverage expected continued growth in demand for data bandwidth in its

markets, and leveraging this infrastructure to service consumers over government owned broadband fibre networks.

The acquisition of Amcom and the merger with M2 created a step-change in earnings, driven by the enhanced scale and

operations of Vocus as a result of these transactions.

Total revenue for the financial year ended 30 June 2016 was $830,825,000 (2015: $149,799,000). The profit for Vocus

after providing for income tax and non-controlling interest amounted to $64,091,000 (2015: $19,850,000).

The increase in revenue of $681,026,000 was attributable principally to the following:

➜➜ Acquisition of Amcom on 8 July 2015;

➜➜ Merger with M2 on 22 February 2016; and

➜➜ Growth in demand for Internet, Fibre / Ethernet and Voice services to corporate customers.

Corporate growth was underpinned by 4,037 on-net buildings and 2,624 metro fibre kilometres in addition to our

undersea fibre network and intercity New Zealand network. Voice services also grew strongly on the back of continued

performance in wholesale call termination services and unified communications.

Consumer revenue growth was derived from Vocus’ merger with M2. Future revenue growth is expected to be underpinned

by growth in broadband services and supported by the NBN churn event where consumers are required to move to the

NBN as the copper network is decommissioned.

20 | VOCUS.COM.AU

Total services in operation at 30 June 2016 were 1,621,000, across mobile, energy, fixed wire and broadband services.

Reducing consumer churn will be a focus for the business as it steps up its investment in brand, systems, customer care and

retention, consistent with its primary goal to be the Most Loved Telco.

Basic earnings per share for Vocus for the financial year ended 30 June 2016 was 18.86 cents (2015: 19.08 cents).

Underlying earnings before interest, tax, depreciation and amortisation (‘Underlying EBITDA’) for the year ended 30 June

2016 was $215,607,000 (2015: $51,570,000). A reconciliation to statutory net profit after tax is shown below:

Consolidated

2016

2015

$'000

$'000

Net profit after tax

64,091

19,850

Add back: Income tax expense

27,914

8,435

Add back: Net finance costs

24,464

5,278

Add back: Depreciation and amortisation

78,487

18,684

194,956

52,247

-

(5,477)

Statutory EBITDA

Gains associated with early repayment of borrowings

Gains on total return swaps (a)

(19,520)

(7,486)

Acquisition and integration costs (b)

40,660

10,400

Gains/losses associated with foreign exchange

(1,445)

629

956

1,257

215,607

51,570

Other gains and losses

Underlying EBITDA

Underlying net profit after tax (‘Underlying NPAT’) for the year ended 30 June 2016 was $101,726,000 (2015:

$18,149,000). A reconciliation to statutory net profit after tax is shown below:

Consolidated

2016

2015

$'000

Net profit after tax

Gains associated with early repayment of borrowings

$'000

64,091

19,850

-

(5,477)

(19,520)

(7,486)

Acquisition and integration costs (b)

40,660

10,400

Gains/losses associated with foreign exchange

(1,445)

629

Amortisation of acquired intangibles arising from purchase price allocation (c)

33,113

594

956

1,257

Gains on total return swaps (a)

Other gains and losses

117,855

19,767

Tax on above

(16,129)

(1,618)

Underlying NPAT

101,726

18,149

Underlying EPS for the year ended 30 June 2016 was 29.87 cents per share (2015: 17.38 cents per share), which is

calculated with reference to Underlying NPAT. The weighted average number of shares on issue for 2016 and 2015 also

been adjusted for the effect of the 1-for-8.9 rights issue undertaken in July 2016, in line with accounting standards.

21

(a) - Gains on total return swaps

The gains on total return swaps for the year ended 30 June 2016 comprises of mark-to-market movements in relation to

Vocus’ 16% relevant interest in Macquarie Telecom Group Limited, net of dividends received, brokerage and interest costs

relating to these total return swap arrangements. The Macquarie Telecom swap is presently scheduled to settle on 30

December 2016. The gains on total return swaps for the previous year comprised realised gains in relation to Vocus’

10% interest in Amcom settled in May 2015 and unrealised gains in relation to its relevant interest in Macquarie Telecom

for that period.

(b) - Acquisition and integration costs

Acquisition and integration costs in the year ended 30 June 2016 primarily comprise legal, professional services and other

costs in relation to the acquisition and integration of Amcom and merger with M2 which completed on 8 July 2015 and

22 February 2016, respectively. Acquisition and integration costs for the previous year primarily relate to transaction costs

in respect of the Bentley, FX Networks and EDC acquisitions and integration costs incurred during the period.

(c) - Amortisation of acquired intangibles arising from purchase price allocation

This refers to amortisation expense incurred in relation to intangible assets recognised on acquisition. These

include customer intangibles and software assets. The intangible assets at 30 June 2016 totalled $446,924,000

(2015: $18,877,000) and have effective lives between 4 and 15 years. The increase is due to the

acquisitions of Amcom and M2.

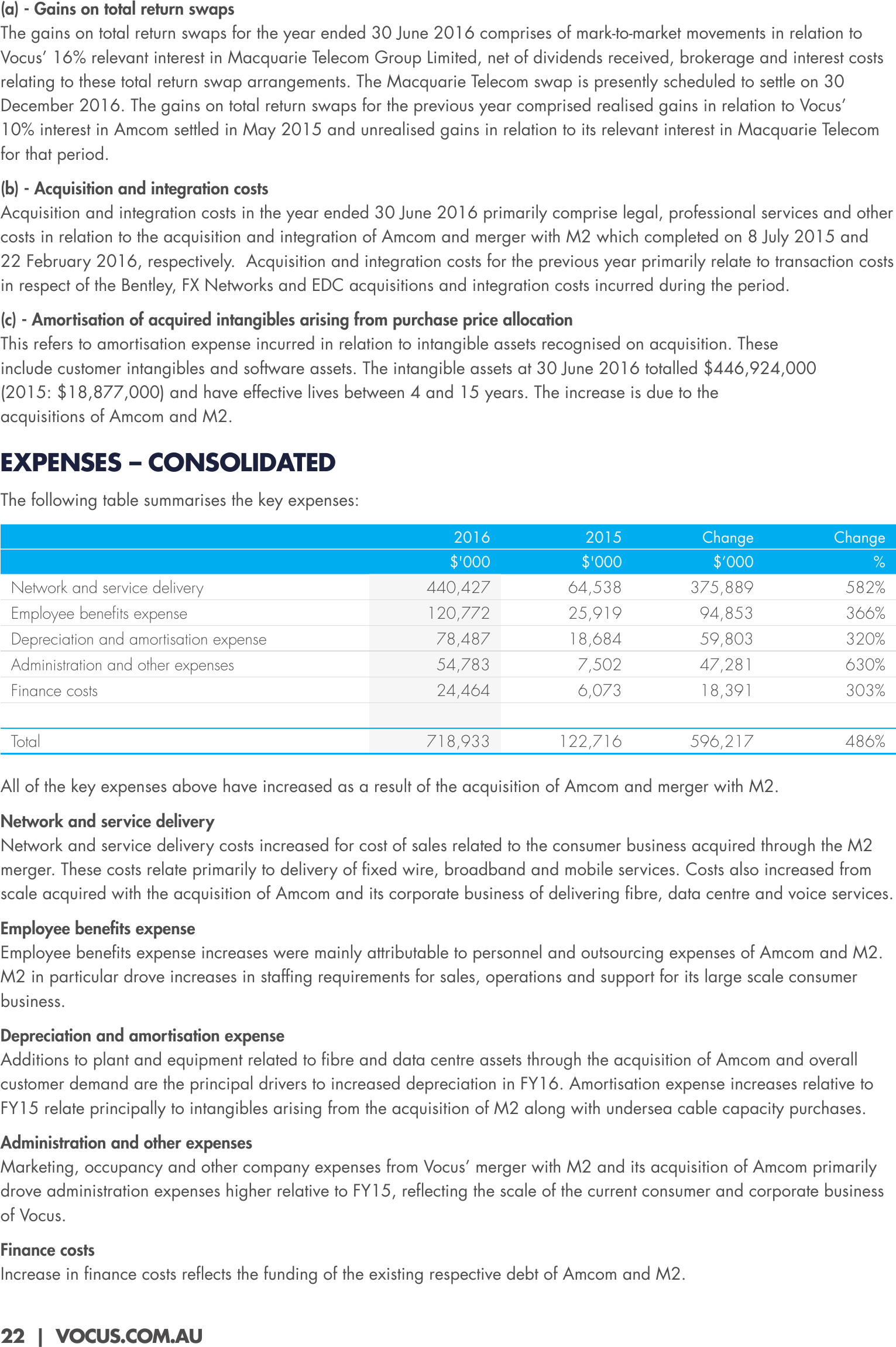

EXPENSES – CONSOLIDATED

The following table summarises the key expenses:

2016

2015

Change

$'000

$'000

$’000

%

Network and service delivery

440,427

64,538

375,889

582%

Employee benefits expense

120,772

25,919

94,853

366%

78,487

18,684

59,803

320%

Depreciation and amortisation expense

Change

Administration and other expenses

54,783

7,502

47,281

630%

Finance costs

24,464

6,073

18,391

303%

718,933

122,716

596,217

486%

Total

All of the key expenses above have increased as a result of the acquisition of Amcom and merger with M2.

Network and service delivery

Network and service delivery costs increased for cost of sales related to the consumer business acquired through the M2

merger. These costs relate primarily to delivery of fixed wire, broadband and mobile services. Costs also increased from

scale acquired with the acquisition of Amcom and its corporate business of delivering fibre, data centre and voice services.

Employee benefits expense

Employee benefits expense increases were mainly attributable to personnel and outsourcing expenses of Amcom and M2.

M2 in particular drove increases in staffing requirements for sales, operations and support for its large scale consumer

business.

Depreciation and amortisation expense

Additions to plant and equipment related to fibre and data centre assets through the acquisition of Amcom and overall

customer demand are the principal drivers to increased depreciation in FY16. Amortisation expense increases relative to

FY15 relate principally to intangibles arising from the acquisition of M2 along with undersea cable capacity purchases.

Administration and other expenses

Marketing, occupancy and other company expenses from Vocus’ merger with M2 and its acquisition of Amcom primarily

drove administration expenses higher relative to FY15, reflecting the scale of the current consumer and corporate business

of Vocus.

Finance costs

Increase in finance costs reflects the funding of the existing respective debt of Amcom and M2.

22 | VOCUS.COM.AU

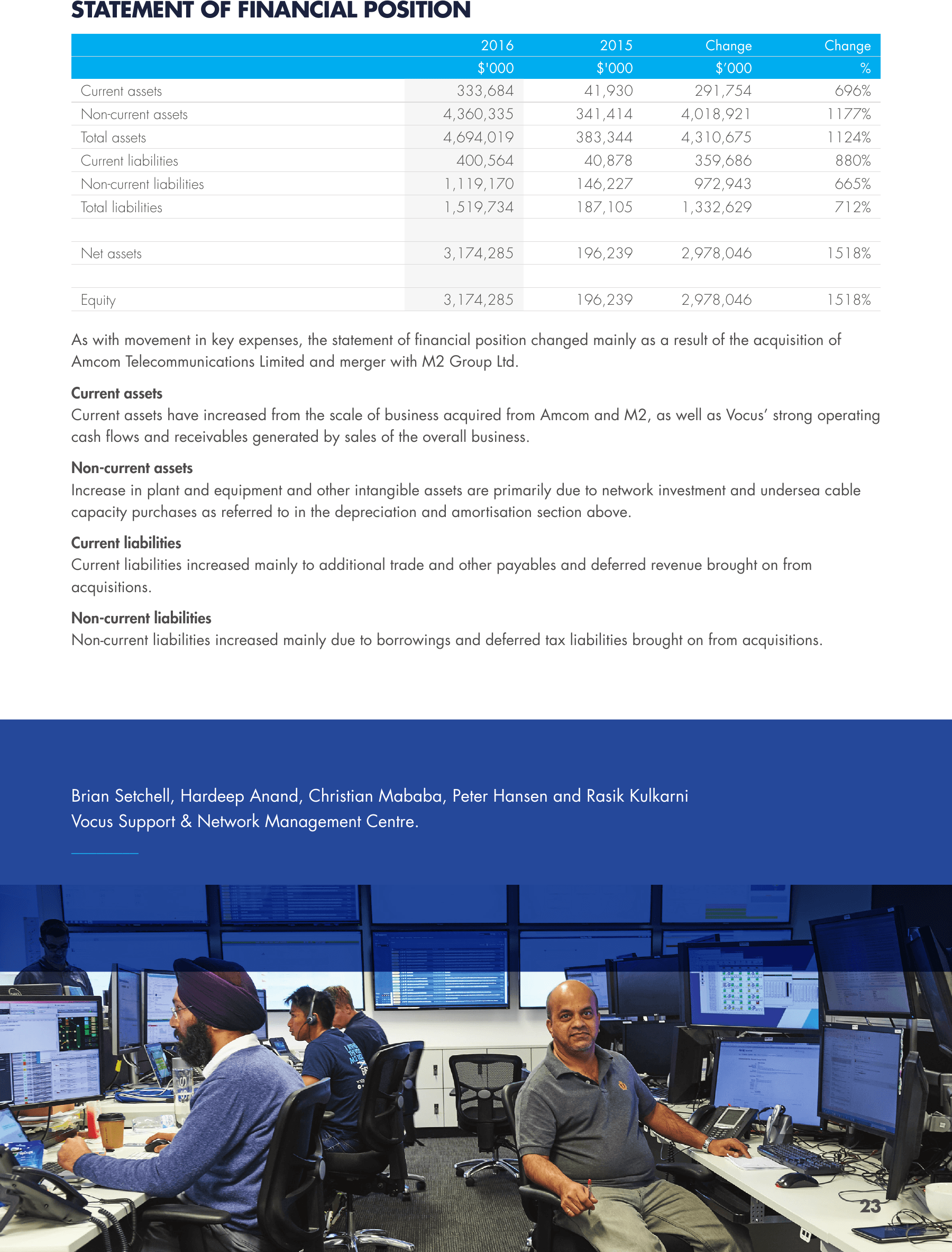

STATEMENT OF FINANCIAL POSITION

2016

2015

Change

Change

$'000

Current assets

$'000

$’000

%

333,684

41,930

291,754

696%

Non-current assets

4,360,335

341,414

4,018,921

1177%

Total assets

4,694,019

383,344

4,310,675

1124%

400,564

40,878

359,686

880%

Non-current liabilities

Current liabilities

1,119,170

146,227

972,943

665%

Total liabilities

1,519,734

187,105

1,332,629

712%

Net assets

3,174,285

196,239

2,978,046

1518%

Equity

3,174,285

196,239

2,978,046

1518%

As with movement in key expenses, the statement of financial position changed mainly as a result of the acquisition of

Amcom Telecommunications Limited and merger with M2 Group Ltd.

Current assets

Current assets have increased from the scale of business acquired from Amcom and M2, as well as Vocus’ strong operating

cash flows and receivables generated by sales of the overall business.

Non-current assets

Increase in plant and equipment and other intangible assets are primarily due to network investment and undersea cable

capacity purchases as referred to in the depreciation and amortisation section above.

Current liabilities

Current liabilities increased mainly to additional trade and other payables and deferred revenue brought on from

acquisitions.

Non-current liabilities

Non-current liabilities increased mainly due to borrowings and deferred tax liabilities brought on from acquisitions.

Brian Setchell, Hardeep Anand, Christian Mababa, Peter Hansen and Rasik Kulkarni

Vocus Support & Network Management Centre.

________

23

CAPITAL MANAGEMENT

During the year Vocus produced net cash inflows

from operating activities of $135,626,000 (2015:

$42,610,000). A significant amount of this has been

reinvested in the network through customer connections

and upgrades to the network to support growth.

There was also $21,078,000 net cash inflow (2015:

$13,597,000) from financing activities net of dividend

payments of $50,860,000 (2015: $2,212,000).

At the reporting date 30 June 2016, consolidated

cash holdings stood at $128,629,000 (2015:

$15,170,000), total drawn debt and lease liabilities

was $886,111,000 (2015: $119,723,000) and

net debt (being total debt less cash holdings) was

$757,482,000 (2015: $104,553,000).

The gearing ratio for Vocus for the year ended 30 June

2016 was 19% (2015: 35%), as measured by net debt

divided by net debt plus equity.

Net debt and gearing reflect Vocus’ trading activity as

well as corporate transactions (merger with M2 Group

Ltd and acquisition of Amcom Telecommunications

Limited). These changes are described below in

significant changes in the state of affairs.

The Group’s bank facility at 30 June 2016 consists

of a $1,234,200,000 senior finance facility (2015:

$131,235,000), comprising a combination of 3

year and 5 year facilities which replaced the existing

syndicated facilities of M2 and Vocus. Interest on the

facility is recognised at the aggregate of the reference

bank bill rate plus a margin. During the current and

prior year, there were no defaults or breaches in

relation to the utilised bank facility.

SIGNIFICANT CHANGES IN THE

STATE OF AFFAIRS

On 8 July 2015, Vocus acquired 100% of the share

capital of Amcom Telecommunications Limited for the

total consideration of $686,662,000. The acquisition

combined two geographically diverse, complementary

businesses to create a major trans-Tasman

telecommunications provider.

On 22 February 2016, Vocus acquired 100% of the

share capital of M2 Group Limited (‘M2’) for a total

consideration of $2,259,628,000. The merger of Vocus

and M2 brings together two complementary business

and creates a vertically integrated, infrastructure backed

full service telecommunications provider with proven

capabilities and scale to service individuals, corporate

and government entities across Australia

and New Zealand.

24 | VOCUS.COM.AU

Following the merger of M2, Vocus entered into

new syndicated banking facilities with a consortium

of Australian and international banks on 27 May

2016. The facilities comprise a combination of 3

year and 5 year facilities, with total facility limits of

A$1,070,000,000 and NZ$160,000,000 (totalling

A$1,234,000,000 as at 30 June 2016), and replaced

the existing syndicated facilities of M2 and Vocus.

There were no other significant changes in the state of

affairs of Vocus during the financial year.

MATTERS SUBSEQUENT TO THE

END OF THE FINANCIAL YEAR

Proposed acquisition of Nextgen Networks and

capital raising

As announced on 29 June 2016, Vocus entered into

a binding agreement to purchase Nextgen Networks

as well as two development projects, NWCS and

ASC (‘Nextgen’), for total upfront consideration

of approximately A$807,000,000 and deferred

consideration of up to A$54,000,000. The proposed

acquisition is subject to standard consents, including

regulatory consent from the Australian Competition

and Consumer Commission (‘ACCC’) and the Infocom

Development Authority of Singapore (‘IDA’). The

acquisition links Vocus’ metro fibre access network

to Nextgen’s intercity backhaul network. The ACCC

announced their decision not to oppose the transaction

on 22 September 2016.

The Nextgen acquisition is funded from a combination

of an equity raising of $652,000,000 completed in July

2016, with the balance funded from existing committed

debt facilities. The equity raising was completed over

three stages, and comprised a pro-rata accelerated

institutional entitlement offer, a pro-rata retail entitlement

offer with rights trading and an institutional placement.

On completion of the entitlement offer, a total of

59,969,757 fully paid ordinary shares were issued at

$7.55 per share, with 30,529,752 new shares issued

on 11 July 2016 pursuing to the institutional entitlement

offer and 29,440,005 new shares issued on 28 July

2016 under the retail entitlement offer. Under the

institutional placement, 23,752,969 ordinary shares at

$8.42 were issued on 11 July 2016.

Apart from the dividend declared as discussed above,

no other matter or circumstance has arisen since 30

June 2016 that has significantly affected, or may

significantly affect Vocus’ operations, the results of

those operations, or Vocus’ state of affairs in future

financial years.

LIKELY DEVELOPMENTS

AND EXPECTED RESULTS OF

OPERATIONS

Demand for data and data services and trends to

outsource information technology requirement as well as

the replacement of the existing copper access networks

operated by Telstra and other carriers in favour of the

wholesale-only access National Broadband Network

being built by the Australian Federal Government is

expected to underpin Vocus’ delivery of communication

and data centre services in financial year 2017.

Consistent with its corporate goal of being the Most

Loved Telco, Vocus intends to invest in systems,

automation and improving customer experience.

ENVIRONMENTAL REGULATION

Vocus Communications has this year prepared its

first annual Sustainability Report . It reviews our

performance from 1 July 2015 to 30 June 2016.

This report has been prepared in accordance with the

Core option of the Global reporting Initiative’s G4

Sustainability Reporting Guidelines. A copy of the

report can be found at vocus.com.au/investors.

We welcome feedback on the report, which may be

sent to investor@vocus.com.au.

Vocus is not subject to any significant environmental

regulation under Australian Commonwealth or

State law.

RISK MANAGEMENT

The Board and the Board Risk Committee have

endorsed a Risk Management Policy and Framework,

which applies to all parts of the Vocus business.

The Chief Risk Officer is the responsible officer for

oversight of the risk management framework and

process. Following is a summary of the key risks faced

by the business in the short to medium term.

Security

Vocus continues to invest significantly in maintaining

and improving the security of its digital assets. A

team of IT security experts is employed to oversee

the network. Security measures implemented include

perimeter firewalls, intrusion prevention/detection

systems, vulnerability scanning of core systems and

application of critical patching, as well as automated

logging of core customer systems.

Privacy

As part of signing up new customers, Vocus collects

and retains personal identifying information. Recently

enacted legislation in relation to Data Retention has

also increased the volume of data being retained. In

addition to the measures taken to ensure the security of

the systems, Vocus ensures that appropriate obligations

for confidentiality and data protection are included

in contractual arrangements with our suppliers, and

comprehensive training is provided to all team members

in relation to complying with our legal obligations in this

area. Vocus maintains appropriate levels of insurance to

provide coverage in the event of a privacy breach, and

has prepared an incident response plan which can be

activated quickly in the event of a breach occurring.

Business continuity

Continuity Plans have been prepared and put in place

to define Vocus’ response to an interruption event such

as disruption to its offices, contact centres or data

centres. Business interruption insurance is also in place.

Financial risks

Vocus’ financial risk exposures include interest rate

risk arising on borrowings and foreign currency risk

arising on non AUD-denominated revenue streams and

suppliers. These risks are hedged where appropriate

and in line with the Group Hedging Policy endorsed

by the Board. Further information in respect of these

risks is outlined in the Financial Instruments note to the

accounts.

Energy

As a retailer of electricity, Vocus purchases electricity

via the Australian Energy Market Operator (AEMO)

at the prevailing price. This is a competitive market

and prices fluctuate with demand. The Wholesale

Energy Risk Management policy sets out our risk

mitigation strategy. Vocus uses hedging instruments

such as Over The Counter derivatives and futures to

mitigate price volatility. Vocus also has a gas storage

agreement to provide certainty over the price of gas.

The Company’s hedging strategy is set by the Board

of Directors with a 12 month horizon, it is reviewed

regularly and monitored by a dedicated Wholesale

Energy Risk Management sub-committee of the Board

Risk Committee.

25